83.7% of Investors Choose the Wrong Investment Vehicle:

83.7% of Investors Choose the Wrong Investment Vehicle: Take the Quiz →

Excellent

Excellent

4.5 Reviews on

4.5 Reviews on

Our Acquisition Process and Methodology

Our Acquisition Process and Methodology

Acquiring an online business requires strategic planning, rigorous evaluation, and protecting your capital at every step. Most buyers either overpay for businesses that don't align with their goals, underestimate hidden risks, or acquire something they can't successfully operate. Our process exists to prevent all three. We represent you exclusively as the buyer, never the seller, which means we're aligned with your interests from day one.

Our structured 10-step process ensures you make informed, confident decisions at every stage, from initial discovery to successful ownership.

Acquiring an online business requires strategic planning, rigorous evaluation, and protecting your capital at every step. Most buyers either overpay for businesses that don't align with their goals, underestimate hidden risks, or acquire something they can't successfully operate. Our process exists to prevent all three. We represent you exclusively as the buyer, never the seller, which means we're aligned with your interests from day one.

Our structured 10-step process ensures you make informed, confident decisions at every stage, from initial discovery to successful ownership.

Latest Press Release

View All

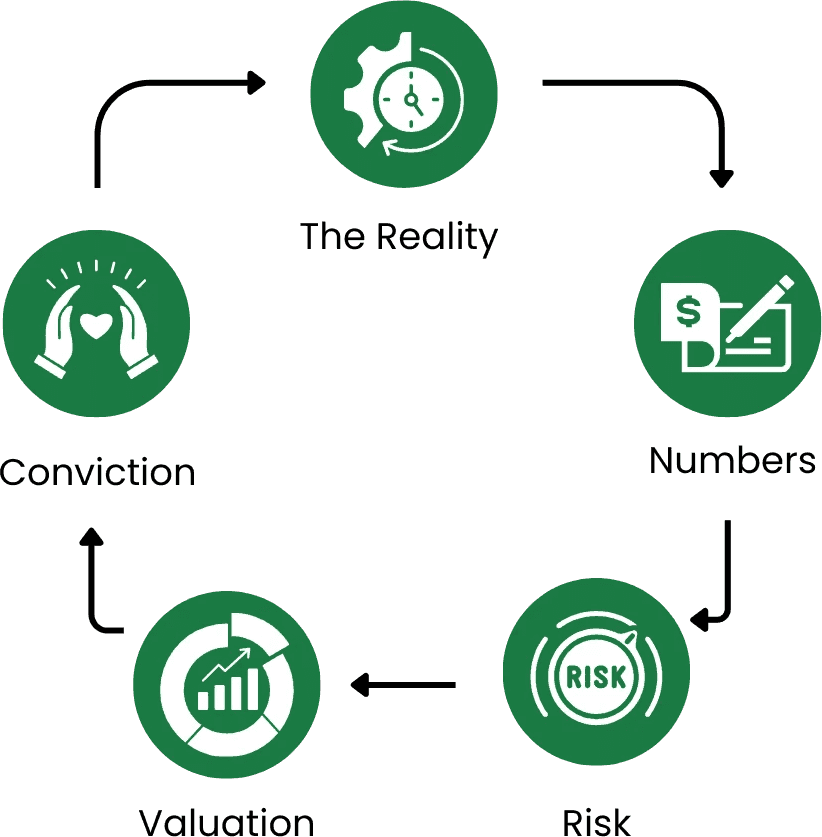

Our structured 10-step process

Ensures you make informed, confident decisions at every stage, from initial discovery to successful ownership.

— PHASE 0

Discovery & Alignment

Everything starts with a focused, one-on-one strategy call.

We take the time to understand who you are as an investor, your goals, experience, available capital, risk tolerance, and long-term vision. It’s a mutual fit assessment.

Learn more

Learn more

PHASE 1

14-Day Trial Activation & Onboarding

Building Your Personalized Acquisition Strategy

Before a single deal is sourced, we lock in precision. You activate the trial, verify capital readiness, and complete our onboarding, giving us everything we need to build a strategy that fits you, not a generic investor profile.

Learn more

Learn more

PHASE 2

The 14-Day Trial (Stages 1–5)

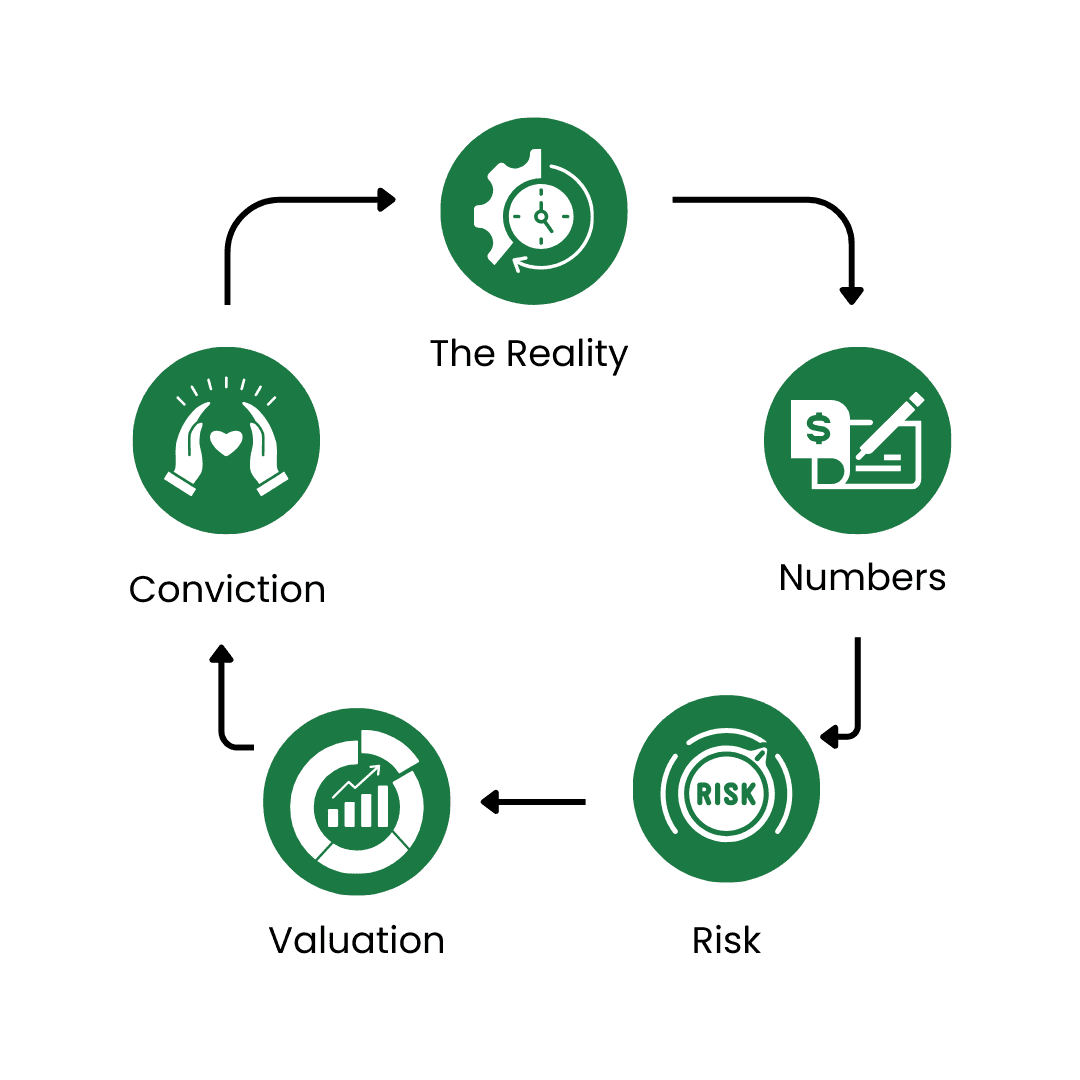

See our Process, Understand the Numbers and Build Conviction.

This is where theory turns into real-world execution.

The 14-Day Trial is immersive, strategic, and hands-on. You don’t just learn what we do, you experience how we think, how we eliminate risk, and how we price businesses properly. You see our process in action before committing long-term.

Learn more

Learn more

PHASE 3

Post-Trial Execution (Stages 6–10)

From Decision to Ownership, With Capital Protection Built In

If you choose to move forward:

50% of the program fee is paid to proceed

The remaining 50% is paid only upon successful acquisition

We’re financially aligned with your outcome.

Typical timeline: 30–120 days.

Learn more

Learn more

Our Portfolio Capital Programs

Tailored solutions for every type of Investor, Entrepreneur and Professional.

Best for Investors

Acquisition Partnership

Buy, Upgrade, Scale & Exit

With this program, Trend Hijacking fully operates the acquired business on your behalf. We manage the entire lean team, handle all marketing, operations, and fulfillment, execute growth strategies, and provide ongoing reporting and performance management. Your involvement is minimal unless you choose otherwise, and we maintain full transparency throughout with detailed reporting and regular updates.

Strategic Acquisition at Below Market Value

Due Diligence & Expert Negotiation

We rebrand, optimize, and position each acquisition for market-leading performance

Scalable strategies drive 5-10x growth within 1-2 years, building high-value brands

Profitable 3-4x Exit Within 1-2 Years

A dedicated team oversees every aspect from acquisition through Exit

Proven 7-Figure Growth Framework

Zero Retainer, Partnership-Based

view more

Best for Investors

Acquisition Partnership

Buy, Upgrade, Scale & Exit

With this program, Trend Hijacking fully operates the acquired business on your behalf. We manage the entire lean team, handle all marketing, operations, and fulfillment, execute growth strategies, and provide ongoing reporting and performance management. Your involvement is minimal unless you choose otherwise, and we maintain full transparency throughout with detailed reporting and regular updates.

Strategic Acquisition at Below Market Value

Due Diligence & Expert Negotiation

We rebrand, optimize, and position each acquisition for market-leading performance

Scalable strategies drive 5-10x growth within 1-2 years, building high-value brands

Profitable 3-4x Exit Within 1-2 Years

A dedicated team oversees every aspect from acquisition through Exit

Proven 7-Figure Growth Framework

Zero Retainer, Partnership-Based

view more

Best for Investors

Acquisition Partnership

Buy, Upgrade, Scale & Exit

With this program, Trend Hijacking fully operates the acquired business on your behalf. We manage the entire lean team, handle all marketing, operations, and fulfillment, execute growth strategies, and provide ongoing reporting and performance management. Your involvement is minimal unless you choose otherwise, and we maintain full transparency throughout with detailed reporting and regular updates.

Strategic Acquisition at Below Market Value

Due Diligence & Expert Negotiation

We rebrand, optimize, and position each acquisition for market-leading performance

Scalable strategies drive 5-10x growth within 1-2 years, building high-value brands

Profitable 3-4x Exit Within 1-2 Years

A dedicated team oversees every aspect from acquisition through Exit

Proven 7-Figure Growth Framework

Zero Retainer, Partnership-Based

view more

Best for Acquisition Entrepreneurs

Smart Acquisition Program

Find, Acquire & Scale with Confidence

After acquisition, you receive 30 days of structured post-acquisition support. This includes complete ownership transfer and operational handover, team onboarding and SOP implementation, growth roadmap development and KPI dashboards, plus weekly strategy calls and ongoing support. If you need continued guidance beyond 30 days, optional extended support is available for a small fee for advisory, team oversight, and growth execution.

Strategic Deal Sourcing of Businesses with strong financials & real growth potential.

In-depth due Diligence & Risk Analysis to ensure you’re buying an asset, not a liability.

Expert Negotiation for securing the best price & terms to maximize your ROI.

Guaranteed Acquisition Below Market Value: Instant Profit on the Buy.

Structured onboarding plan for an effortless takeover.

Own It, Don’t Operate It: We Set Up the Right Team & Systems.

30-Day Post: Acquisition Support

Growth Roadmap & Scaling Strategy

Proven 7-Figure Growth Framework: To Maximize Your Investment.

No Retainers, ZERO Equity: 100% Ownership Stays With You.

14-Day Trial: Test our process, with zero obligations.

view more

Best for Acquisition Entrepreneurs

Smart Acquisition Program

Find, Acquire & Scale with Confidence

After acquisition, you receive 30 days of structured post-acquisition support. This includes complete ownership transfer and operational handover, team onboarding and SOP implementation, growth roadmap development and KPI dashboards, plus weekly strategy calls and ongoing support. If you need continued guidance beyond 30 days, optional extended support is available for a small fee for advisory, team oversight, and growth execution.

Strategic Deal Sourcing of Businesses with strong financials & real growth potential.

In-depth due Diligence & Risk Analysis to ensure you’re buying an asset, not a liability.

Expert Negotiation for securing the best price & terms to maximize your ROI.

Guaranteed Acquisition Below Market Value: Instant Profit on the Buy.

Structured onboarding plan for an effortless takeover.

Own It, Don’t Operate It: We Set Up the Right Team & Systems.

30-Day Post: Acquisition Support

Growth Roadmap & Scaling Strategy

Proven 7-Figure Growth Framework: To Maximize Your Investment.

No Retainers, ZERO Equity: 100% Ownership Stays With You.

14-Day Trial: Test our process, with zero obligations.

view more

Best for Acquisition Entrepreneurs

Smart Acquisition Program

Find, Acquire & Scale with Confidence

After acquisition, you receive 30 days of structured post-acquisition support. This includes complete ownership transfer and operational handover, team onboarding and SOP implementation, growth roadmap development and KPI dashboards, plus weekly strategy calls and ongoing support. If you need continued guidance beyond 30 days, optional extended support is available for a small fee for advisory, team oversight, and growth execution.

Strategic Deal Sourcing of Businesses with strong financials & real growth potential.

In-depth due Diligence & Risk Analysis to ensure you’re buying an asset, not a liability.

Expert Negotiation for securing the best price & terms to maximize your ROI.

Guaranteed Acquisition Below Market Value: Instant Profit on the Buy.

Structured onboarding plan for an effortless takeover.

Own It, Don’t Operate It: We Set Up the Right Team & Systems.

30-Day Post: Acquisition Support

Growth Roadmap & Scaling Strategy

Proven 7-Figure Growth Framework: To Maximize Your Investment.

No Retainers, ZERO Equity: 100% Ownership Stays With You.

14-Day Trial: Test our process, with zero obligations.

view more

Why This Process Works

Why This Process Works

Most people who buy online businesses either overpay, underestimate risk, or acquire something misaligned with their goals. Our process prevents all three.

We don't rush. We don't overpromise. We represent your interests exclusively, and we structure every step to protect your capital and maximize your probability of success.

From the moment we start working together, you'll know exactly what to expect and you'll have experienced operators guiding you through every decision, negotiation, and transition.

Because acquiring a business isn't just a transaction. It's the beginning of a wealth-building journey and we're here to make sure you get it right.

Most people who buy online businesses either overpay, underestimate risk, or acquire something misaligned with their goals. Our process prevents all three.

We don't rush. We don't overpromise. We represent your interests exclusively, and we structure every step to protect your capital and maximize your probability of success.

From the moment we start working together, you'll know exactly what to expect and you'll have experienced operators guiding you through every decision, negotiation, and transition.

Because acquiring a business isn't just a transaction. It's the beginning of a wealth-building journey and we're here to make sure you get it right.

To Know More About Our Process

To Know More About Our Process

ecommerce deals

*DISCLAIMER: All testimonials shown are real but do not claim to represent typical results. Any success depends on many variables that are unique to each individual, business, and product market opportunity, including commitment and effort. Testimonial results are meant to demonstrate what the most dedicated partners, clients, and students have done and should not be considered average. Trendhijacking.com makes no guarantee of any financial gain from the use of its products or services.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

ecommerce deals

*DISCLAIMER: All testimonials shown are real but do not claim to represent typical results. Any success depends on many variables that are unique to each individual, business, and product market opportunity, including commitment and effort. Testimonial results are meant to demonstrate what the most dedicated partners, clients, and students have done and should not be considered average. Trendhijacking.com makes no guarantee of any financial gain from the use of its products or services.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

ecommerce deals

*DISCLAIMER: All testimonials shown are real but do not claim to represent typical results. Any success depends on many variables that are unique to each individual, business, and product market opportunity, including commitment and effort. Testimonial results are meant to demonstrate what the most dedicated partners, clients, and students have done and should not be considered average. Trendhijacking.com makes no guarantee of any financial gain from the use of its products or services.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.