83.7% of Investors Choose the Wrong Investment Vehicle:

83.7% of Investors Choose the Wrong Investment Vehicle: Take the Quiz →

Excellent

Excellent

4.5 Reviews on

4.5 Reviews on

our Featured Ecommerce Business Assets for Sale

Browse our selection of vetted ecommerce stores for sale, including profitable, high-performing Shopify stores for sale. Find the perfect ecommerce business for sale and start your entrepreneurial journey today.

Browse our selection of vetted ecommerce stores for sale, including profitable, high-performing Shopify stores for sale. Find the perfect ecommerce business for sale and start your entrepreneurial journey today.

Filter by Collection

Filter by Collection

Filter by Collection

Favorites

Favorites

Favorites

Off

Mar 5, 2026

Design and Style

Women’s Apple Watch Strap Brand | $16.9M Revenue Accessory Business

A 3.5 year old E-Commerce Business Specializing in Premium Watch Straps $14.16M TTM Revenue | $1.25M TTM Profit | Strong returning customer rate & Community

Asking Price:

$2,400,000

Mar 5, 2026

Health and Beauty

Mobility & Wellness Ecommerce Brand | Fast-Scaling DTC

A 6 month old health and wellness-focused brand | Scaling in the EU & UK with 1.3K Revenue | 206K Net Profit | Ready for Q1

Asking Price:

$164,513

Mar 5, 2026

Design and Style

Glowing Phone Case Ecommerce Store - $60K Revenue & $30K Profit

A 8-Month-Old Organic Shopify & TikTok Shop Brand Selling Glowing Cases. $60K Total Revenue, $30K Total Profit.

Asking Price:

$60,000

Mar 5, 2026

Lifestyle

Women’s Seamless Underwear E-commerce Store | 41% Profit Margin

Ecommerce shop selling seamless bras and panties for women|41% profit margin|LTTM $675k revenue|LTTM 275k profit

Asking Price:

$353,254

Mar 4, 2026

Health and Beauty

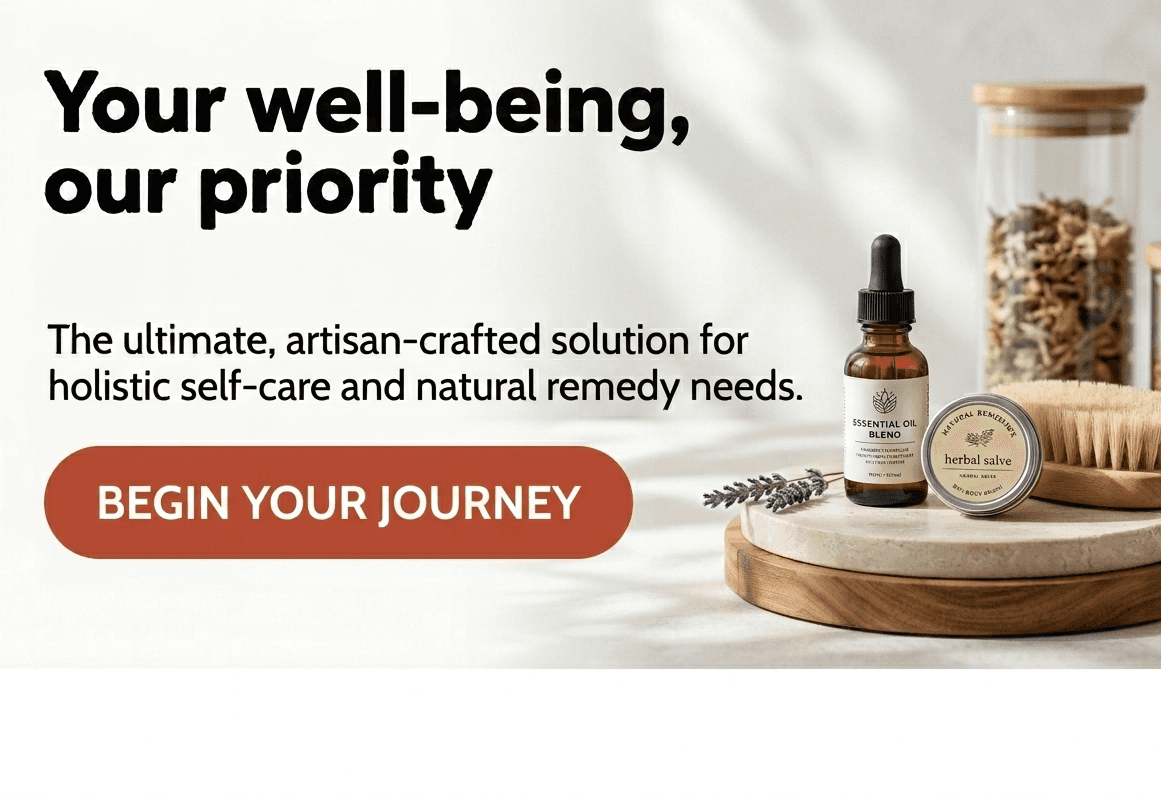

Natural Remedies And Self-care Products Ecommerce Brand | Multi-Model Scalable Business

This business offers natural remedies and self-care products to help improve mental, physical, and emotional well-being.

Asking Price:

$4,309,039

Mar 4, 2026

Hobbies and Games

Lego Collectibles Ecommerce Store for Sale | €1M+ Revenue in Global Markets

International Lego products store serving Germany, France, Canada, and Asia. Over €1M in revenue with strong demand in the hobby and collectibles niche.

Asking Price:

$230,463

Mar 3, 2026

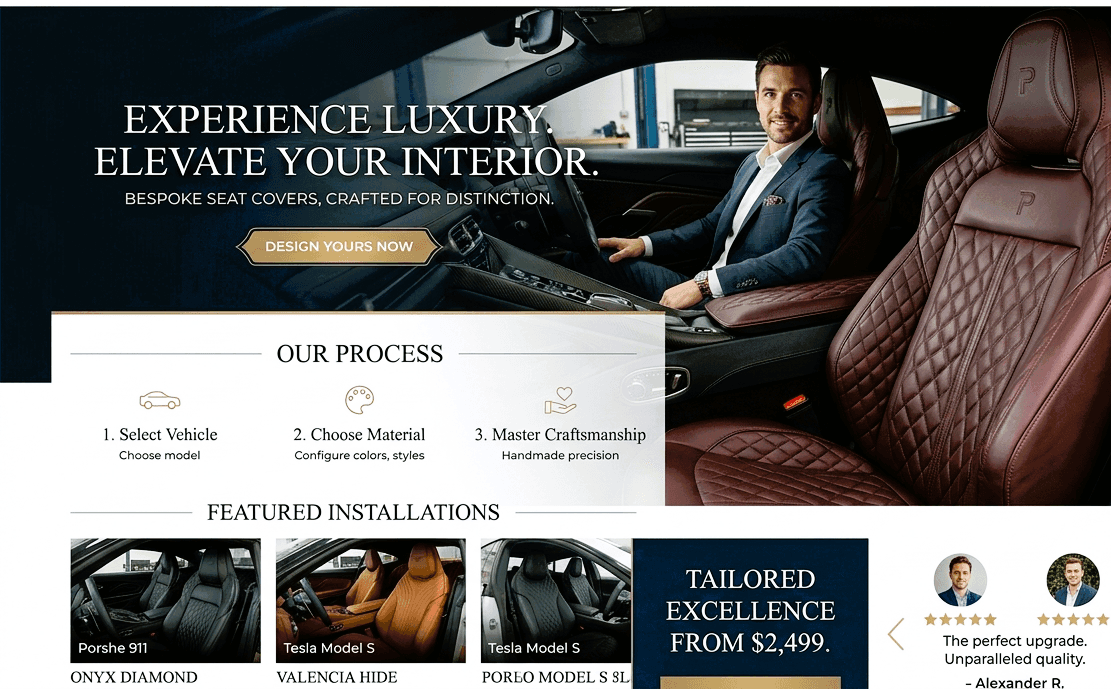

Automotive

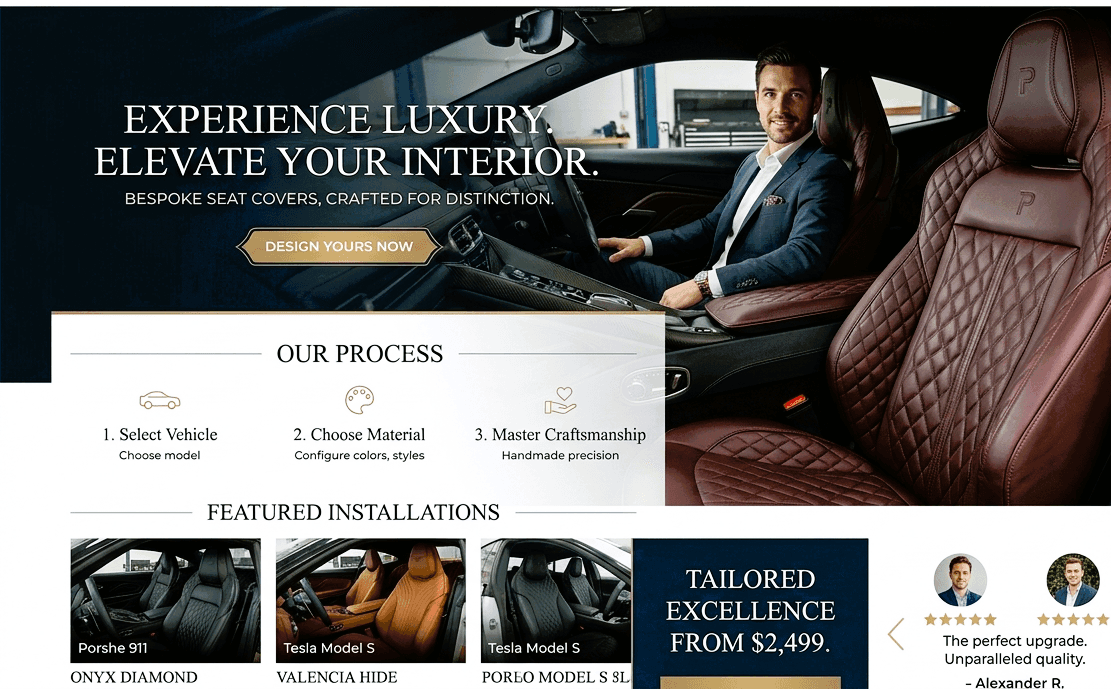

Premium Leather Truck Seat Cover E-commerce Brand | $5K Monthly Profit

1 year old ecommerce brand selling high ticket custom seat covers. Big profits. Heavily scaling right now.

Asking Price:

$281,000

Mar 3, 2026

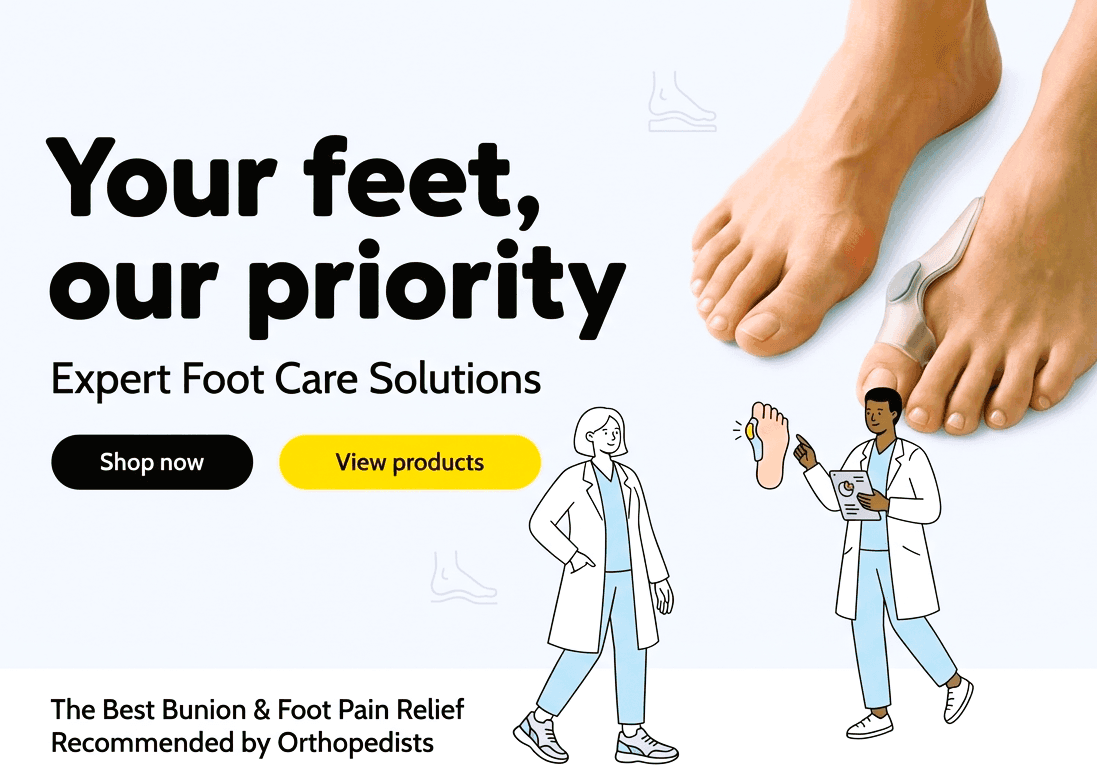

Health and Beauty

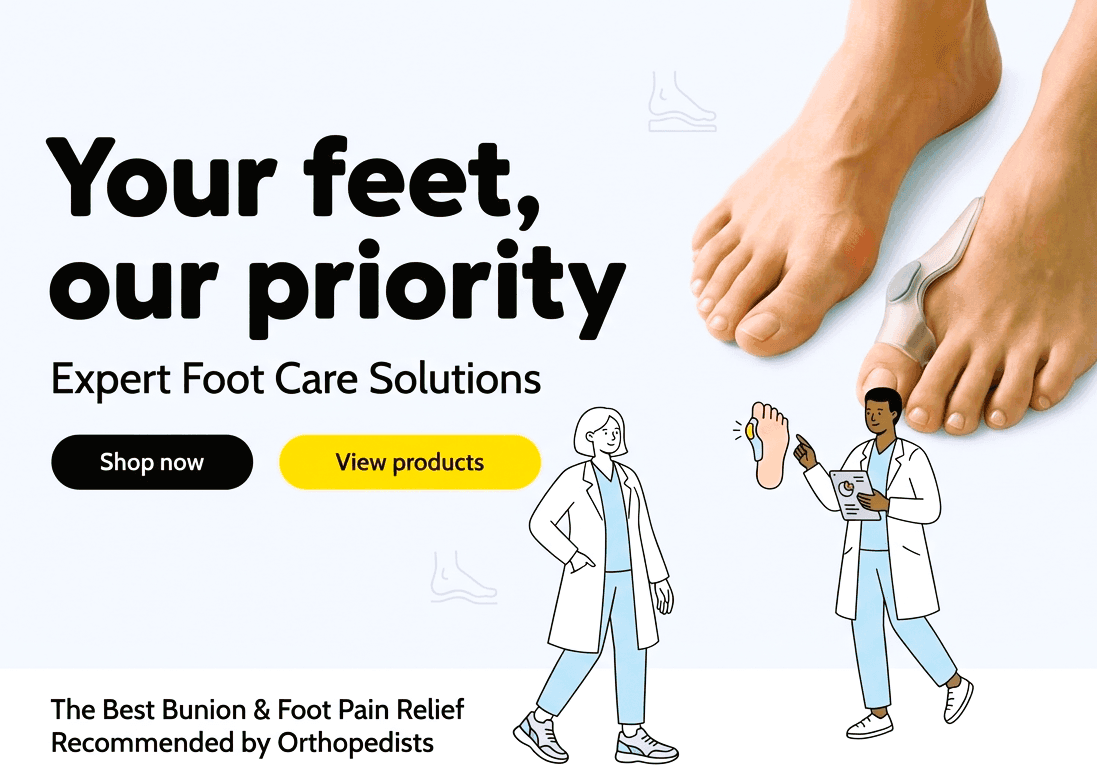

DTC Foot Health E-commerce Brand | $880K Revenue & 27% Margin

Established DTC Brand in Foot Health. $880K Revenue, 27% Margin, 11K Customer Base, Positioned for scale.

Asking Price:

$85,000

Mar 3, 2026

Pets

Innovative Cat Products E-commerce Brand | $1.78M Revenue Paid Ads

1 Year 7 Month Old Shopify Brand Selling Viral Cat Products. Total Revenue $1.78M | Total Net Profit $248K | Facebook Ads With Automated Team, Ready For Q1

Asking Price:

$210,000

Feb 26, 2026

Health and Beauty

Gut Health Supplement E-commerce Brand | Amazon & TikTok Growth

Established 9 y-old U.S.-Based Supplement Brand with $3.23M TTM Revenue and $533K Profit - Scalable DTC Operations on Amazon, Shopify, and TikTok Shop

Asking Price:

$2,500,000

Feb 26, 2026

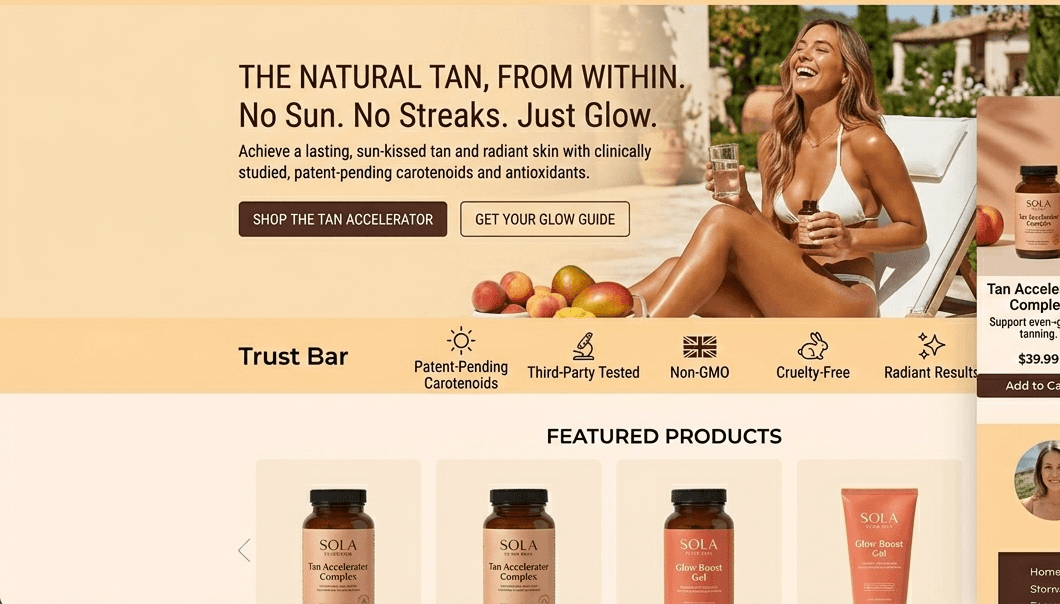

Health and Beauty

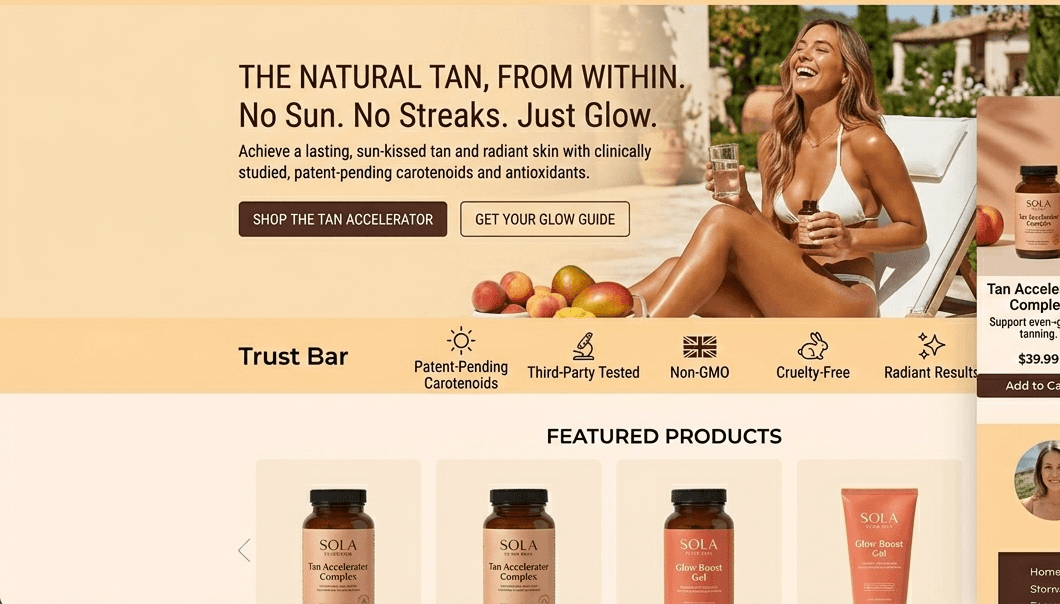

Self-TanningSupplement Shopify Brand | $2.25M Revenue & $554K Net Profit

Supplement Brand | $2.5M Total Revenue | $617 Net Profit

Asking Price:

$600,000

Feb 24, 2026

Home and Garden

Minimalist Tool Accessories Brand | Strong Margins & Scale

Lightweight, minimalist tool accessories brand with strong unit economics, simple operations, and clear expansion potential across ads and marketplaces.

Asking Price:

$145,000

Feb 24, 2026

Health and Beauty

Baby Teething Relief Brand | €435K Revenue, 80%+ Gross Margin

€435K Revenue Baby Ecommerce Brand | 38% Net Margin | Fully Automated | 3–4 Hrs/Week

Asking Price:

$210,000

Feb 24, 2026

Design and Style

AHS-Style Streetwear Shopify Store | $153K+ Revenue, 14.3K+ Customers

Fast-growing solo-run streetwear brand: $153K+ revenue, 14.3K+ customers, $50 AOV, 127K+ visitors, 79K organic searches, high margins & huge growth potential!

Asking Price:

$180,000

Feb 23, 2026

Design and Style

US Jewelry Brand | $5.8M Revenue & $1.5M Net Profit

A 2.7 Year Old Jewelry Store Selling In U.S. Total Revenue $5.8M | Toal Net Profit $1.5M | Cash flowing With Constant Profits

Asking Price:

$125,000

Feb 23, 2026

Design and Style

Profitable Digital Software E-commerce Business | $20K Monthly Profit

Profitable digital software brand earning $20K/month at 100% margin, 1,000+ users, and fully automated operations ~ scalable, turnkey growth

Asking Price:

$120,000

Feb 23, 2026

Health and Beauty

US Health Subscription E-commerce Brand | Trademarked & Funnel Proven

US market, health brand with subscriptions, 14K email subscribers, registered trademark, custom product/packaging. Proven funnels.

Asking Price:

$150,000

Feb 18, 2026

Design and Style

Watch Bands Company for Sale | DTC E-commerce Brand

Built in 2021 (4 Years Old) | Branded Watch Band Store| Dedicated Supplier Relationship | Only using Facebook Ads | In-house High-Quality Creative Content Only

Asking Price:

$320,000

Feb 18, 2026

Design and Style

Anime-Inspired Watches Shopify Brand - $177k+ Revenue

A 6 Month Old Organic Shopify Brand Selling Anime Watches With $177k+ Revenue And $95k Profit. Automated, 110k + Followers, Ready To Scale Long Term With Ads.

Asking Price:

$99,999

Feb 18, 2026

Design and Style

Automated Fashion And Footwear E-commerce Business

Automated Fashion Ecom | $9M Sales, $1.1M Profit | EU Market, Minimal Tariff Risk

Asking Price:

$2,590,000

Feb 17, 2026

Design and Style

Anime Watches Organic Shopify Brand | $294K Revenue & $153K Net Profit

A 11 Month Old Organic Shopify Brand Selling Anime Watches | $294K Revenue & $153K Net Profit | 66K+ Followers, Automated Brand With Huge Scale Potential

Asking Price:

$100,000

Feb 17, 2026

Design and Style

Organic Shopify Anime Brand | $406K Revenue

1 Year 9 Month Old Organic Shopify Brand in the Anime Niche | $406K+ Revenue & $193K+ Net Profit | 680K+ Followers, Automated Brand for a First-Time Buyer

Asking Price:

$150,000

Feb 17, 2026

Home and Garden

Shopify Brand Selling Trending Products | $1.5M Revenue

1 Year Old Google Ads Shopify Brand Selling Trending Products | $1.5M+ Revenue & $292K+ Net Profit | Automated Systems, Team Included | Scalable Paid Traffic

Asking Price:

$120,000

Feb 17, 2026

Hobbies and Games

Viral Alcohol Bottle Toys Shopify Brand | High Profit Brand

8 Month Old Organic Shopify Brand Selling Viral Alcohol Bottle Toys | $156K+ Revenue & $88K+ Net Profit | Automated Brand, Easy To Run for a First-Time Buyer

Asking Price:

$60,000

Feb 9, 2026

Hobbies and Games

Keepsake Gifts Ecommerce Store | High Margin Shopify Brand

A 6 Month Old Organic Shopify Brand Selling Emotionally Driven Keepsake Products | $325K+ Revenue & $154K+ Net Profit | High-Margin, Easy To Scale For New Buyer

Asking Price:

$120,000

Feb 9, 2026

Lifestyle

Barefoot Footwear Shopify Brand | High Profit and Strong Demand

A Thriving 2-Year-Old Barefoot Shoe Brand in Europe, Generating 2.19M in Revenue and 471K in Profit. Ideal Growth Opportunity in the Expanding DACH Market.

Asking Price:

$462,085

Feb 6, 2026

Pets

Custom Pet Gift E-commerce Business On Sale | $333K Revenue High Profit

1 Year Old Organic Shopify Brand Selling Custom Pet Figures | $333K Revenue & $148K Net Profit | Automated, Emotional Gift Brand Built To Scale Long Term

Asking Price:

$120,000

Feb 6, 2026

Health and Beauty

Vaginal Health Supplement E-commerce Brand | High Profit Subscription Model

Explosive 1+ Year Old Vaginal Health Supplement Brand. Generating Over $400,000 Net Profit And $685k+ Total Revenue. With $10k+ Monthly Subscriptions

Asking Price:

$99,999

Feb 4, 2026

Education

Digital Budgeting Products Ecommerce Store | High Profit Automated

A 1 Year, 7 Month Old Organic Shopify Brand Selling Digital Budgeting Products | $307K+ Revenue & $223K+ Net Profit | Automated Asset For First-Time Buyers Now.

Asking Price:

$130,000

Feb 2, 2026

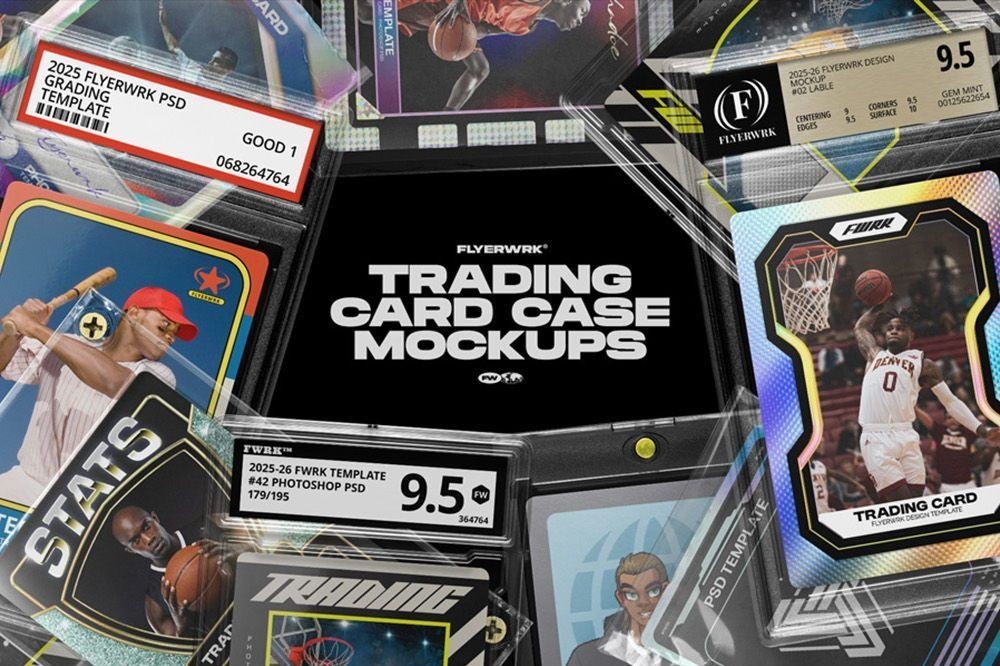

Hobbies and Games

TCG Accessories Ecommerce Store | Profitable Multi Channel

Profitable TCG accessories brand with $135K revenue, $45K profit, 30% margin, multi-channel sales, 0% refund rate, and 32K+ annual site users

Asking Price:

$96,750

Jan 30, 2026

Health and Beauty

FDA Approved Breath Spray Shopify Store | Unique Multi Flavor Product

Unique brand with scaling potential.

Asking Price:

$288,000

Jan 30, 2026

Health and Beauty

Subscription-Based Supplements Ecommerce Brand for Sale | $528K Revenue

A 9 Month Old Supplement Brand Selling In The U.S Market. Over $50,000 In Monthly Subscribers. Total Revenue Exceeds $528k With A NET Profit Of $105k.

Asking Price:

$105,000

Jan 29, 2026

Hobbies and Games

Toy Guns Ecommce Store for Sale | $1.1M Revenue, High Profit

A 1 Year 8 Month Old Organic Shopify Brand Selling Toy Guns With $1.1M+ Revenue & $480K+ Profit. 1.64+ Million Subscribers, Automated Team To Scale Long Term.

Asking Price:

$225,000

Jan 29, 2026

Health and Beauty

Supplement Ecommerce Brand for Sale | 61% Margins & Scalable

8-year wellness brand with $105K revenue, 61% profit margins, proprietary supplements, and untapped marketing channels ~ stable and highly scalable

Asking Price:

$100,000

Jan 29, 2026

Design and Style

Men’s Jewelry E-commerce Business | High Margins and Low Involvement

The e-commerce brand offers stylish and high-quality accessories for the modern man, featuring bags, bracelets, necklaces, and accessories that elevate personal style.

Asking Price:

$445,531

Jan 26, 2026

Sports and Outdoor

Electric Water Sports Ecommerce Store for Sale | Premium Gear

3 years old profitable online store for premium, mostly electric water sports gear. Scalable business with strong brand & growth potential.

Asking Price:

$117,499

Jan 26, 2026

Home and Garden

Washable Rug Shopify Store for Sale | $495K Revenue & $500K Inventory

Established U.S. Shopify Plus rug brand with $495K revenue, 166K customers, full warehouse setup, plus $500K inventory included for $200K.

Asking Price:

$200,000

Jan 26, 2026

Fashion

Women’s Functional Fashion Shopify Store for Sale:

A 1-year-old rapid growth D2C in women functional fashion niche. $7m revenue in 6months. Great potential for expanding to new markets and product portfolio

Asking Price:

$1,500,000

Jan 23, 2026

Baby

Baby Care Dropshipping Store for Sale | $280K Revenue Australia

A 7-month-old Australian Dropshipping Store Selling Baby Care Products. Over $280K Total Revenue | Net Profit Exceeds $61k | Perfect For First Time Buyers

Asking Price:

$65,000

Jan 23, 2026

Education

Profitable Online Tutoring Platform for Sale | Scalable Education Business

A platform connecting students with academic experts for homework assistance, offering tutoring services across various subjects.

Asking Price:

$155,000

Jan 23, 2026

Design and Style

Profitable Custom Sticker E-Commerce Business | $307K Revenue, 187% Growth

Profitable eCommerce business with $307K revenue, $64K profit, 21% margin, and 187% growth in 2024. High-quality custom stickers and strong customer base.

Asking Price:

$105,555

Jan 23, 2026

Automotive

Profitable Custom Seat Covers Shopify Brand for Sale

1 year old ecommerce brand selling high ticket custom seat covers. Big profits. Heavily scaling right now.

Asking Price:

$280,000

Jan 21, 2026

Design and Style

Wholesale Clothing Manufacturer E-commerce Brand| €2.1M Revenue & 28% Margin

Established manufactory business with $2.2M revenue and 38% profit margin. Founded in 2002, a standout opportunity in the industry.

Asking Price:

Sold

Jan 21, 2026

Health and Beauty

Profitable Eco-friendly Products E-commerce With $132K/M Revenue

Eco-friendly online store offering ethical and sustainable products for a conscious lifestyle. From skincare to home decor, all items are ethically sourced.

Asking Price:

$1,500,000

Jan 20, 2026

Health and Beauty

Lipstick Ecommerce Store | $316K Revenue in 6 Months

A 6 Month Old Lipstick Brand Selling In The U.S Market. Total Revenue Exceeds $316k Whilst Netting $47k. Ready For New Onwership & Fresh Minds

Asking Price:

$40,000

Jan 20, 2026

Hobbies and Games

Digital Products E-commerce Store Selling RPG Maps & Resources

A Digital Platform for Custom RPG Map Creation. Over $836k TTM Revenue | $239k TTM Net Profit.

Asking Price:

$295,000

Jan 16, 2026

Health and Beauty

Eye Care Ecommerce Store for Sale | Honey Based Wellness Products

Shopify store for sale: Sells eye care oriented products: honey-based eye drops, dry-eye masks, blue-light-blocking glasses, and honey-based immunity honey.

Asking Price:

$265,000

Jan 16, 2026

Gardening

Home and Garden Dropshipping Store for Sale | 6 Year Profitable Business

This is a 6-year-old online-based business that is family-owned & operated. Profitable & easy to run working few hours a day. Private suppliers and dropshipping

Asking Price:

$199,000

Jan 15, 2026

Design and Style

Barefoot Footwear Ecommerce Brand for Sale $3.4M Revenue and $800K Profit

An Approaching 3 Year Old Shoe Brand Selling In The U.S & International Markets. Total Revenue $3.4M | Net Profit $800k+ | Consistent & Stable

Asking Price:

$265,000

Jan 14, 2026

Education

Profitable Education Services Business for Sale | 15-Year Track Record

Profitable 15-year education-services biz with 93% margins, $140K revenue, and $130K profit. Scalable model, strong SEO, and low overheads

Asking Price:

$208,658

Jan 14, 2026

Hobbies and Games

RPG Tabletops Digital Products Store for Sale | Profitable & Scalable

Lean digital ecommerce business selling RPG tabletop products. $775K+ sales, 40K+ fans, and turnkey plug-and-play setup for scalable growth.

Asking Price:

$95,000

Jan 14, 2026

Design and Style

Premium Watch Ecommerce Store for Sale | High-End Made-to-Order Timepieces

A premium and independent watch brand specializing in high-end, made-to-order timepieces with a strong emphasis on craftsmanship and design.

Asking Price:

$49,999

Dec 19, 2025

Health and Beauty

Automated Nail Care Ecommerce Store for Sale | High Margin & Scalable

Profitable automated eCommerce brand earning $5K/mo profit at 31% margins ~ scalable nail care business with 12K reviews and strong global growth potential

Asking Price:

$48,848

Dec 19, 2025

Design and Style

Profitable Custom Jewelry Ecommerce Store for Sale | 3+ Years & $3.25M Revenue

A 3+ Year Old Online Store Selling Custom Gifting Jewerly Products. Total Revenue Exceeds $3.25M Whilst Netting a Profit Of $800k. Perfect Timing For Q4

Asking Price:

$199,999

Dec 18, 2025

Health and Beauty

Premium Orthopedic Supplies Brand | $19M Revenue | 25% EBITDA

Premium Orthopedic Supplies Brand with 19M+ TTM Revenue, 25% EBITDA Margins, and Global Reach. Scalable, Profitable, and Primed for Expansion

Asking Price:

Sold

Dec 18, 2025

Design and Style

Remote 3D CAD Design Ecommerce Business for Sale | 89% Margins

High-margin design service biz with 89% profit, 15% YoY growth, 80%+ repeat clients, and $60K+ annual profit - fully remote with scalable operations

Asking Price:

$120,000

Dec 17, 2025

Electronics

Retro Projector Ecommerce Store for Sale | High Margin DTC Electronics

Highly profitable eCom brand with $250K revenue in 11 months, 39K+ social followers, and influencer-driven growth ready to scale

Asking Price:

$48,936

Dec 17, 2025

Health and Beauty

Eco Shower Filter Ecommerce Store for Sale | High Margin DTC Brand

Profitable eco eCom brand with 38% margins, 28K+ email subs, 29K customers, and $73K TTM sales. Turnkey, scalable, and primed for EU market growth

Asking Price:

$75,659

Dec 17, 2025

Health and Beauty

Profitable US-based Supplement Brand | Repeat Purchase 30%

Profitable US-based supplement brand with transparent formulas | Repeat Purchase Rate 30%, scalable, low-maintenance, global growth potential.

Asking Price:

$246,701

Dec 11, 2025

Home and Garden

Automated Eco-Friendly Shopify Store for Sale | $800K Revenue & $160K Profit

A Fully Automated Home & Garden Shopify Store Running In U.S. Market. Total Profit $160k + | Total Revenue Generated $800k+ | Perfect For First Time Buyers

Asking Price:

$75,000

Dec 10, 2025

Health and Beauty

Sleep & Performance Ecommerce Store for Sale | Nose Strips & Mouth Tape

Nose strips and mouth tape that boost your performance and give you sleep like never before! Breathe easy, sleep like a pro, and crush your goals!

Asking Price:

$129,847

Dec 10, 2025

Business

Digital Mockups Ecommerce Store for Sale | High Margin and Scalable

Profitable digital e-commerce brand with 73% margins, $2.2K avg. monthly profit, 41% repeat buyers, and strong growth from global customers

Asking Price:

$70,000

Dec 10, 2025

Crochet Ecommerce Store for Sale | Automated Brand with Strong Sales

2 Year Old Automated Crochet brand with $336K sales, 800K followers, Monthly Recurring Revenue and Viral Organic Social Media Sales

Asking Price:

$44,550

Dec 9, 2025

Health and Beauty

Hosiery And Compression Socks Dropshipping Business for Sale | High Margin and Low Risk

Profitable e-commerce business in health & beauty with USD $76K revenue, 48% profit margin, and steady growth ~ low-risk, scalable model with dropshipping

Asking Price:

$58,283

Dec 5, 2025

Design and Style

Lingerie Dropshipping E-commerce Business | Profitable Niche With Proven Demand

A 3-year-old turnkey e-commerce business in the lingerie industry (women's and men's), running in almost auto-pilot mode. High potential for growth.

Asking Price:

$98,047

Dec 3, 2025

Health and Beauty

Smart Health E-commerce Brand | $303K Revenue, $105K Profit, 35% Margins

Smart health brand with $303K revenue, $105K profit, 35% margins, 6K customers, and 350% YoY growth ~ scalable in the booming digital wellness market

Asking Price:

$272,460

Dec 3, 2025

Health and Beauty

Profitable UK Dental E-commerce Brand | 61% margins, High Growth Potential

Profitable UK eCommerce dental brand with 61% margins, $8.7K monthly profit, retailer contracts, and huge growth potential in health & beauty

Asking Price:

$59,000

Dec 3, 2025

Pets

Automated Pet E-Commerce Business | Strong ROAS & Loyal Customers

Profitable Automated Pet E-Commerce | 97% Hands-Off | A$300K+ Revenue | 3.43% Conversion Rate | No Inventory Needed | 3x ROAS

Asking Price:

$111,388

Dec 2, 2025

Home and Garden

Premium Candles Shopify Brand | $792K Revenue, $135K Profit, 17% Margins

Profitable candle brand with $792K revenue, $135K profit, 17% margins, viral TikTok sales, and multi-channel growth ~ perfectly timed for Q4 scale

Asking Price:

$150,000

Dec 2, 2025

Home and Garden

Automated Shopify Store for Sale | Stylish Home Décor Niche

Profitable home dcor brand with $432K revenue, $16.9K monthly profit, 53% margin, and 95% organic traffic ~ turnkey, automated, and ready to scale

Asking Price:

$199,999

Dec 2, 2025

Design and Style

Handcrafted LED Art Ecommerce Brand | Strong Profit and Growth Upside

Profitable LED art brand selling handcrafted illuminated artworks worldwide. Strong margins, global clients, and multi-channel sales model.

Asking Price:

$86,500

Nov 28, 2025

Health and Beauty

Virtual Mental Health Clinic | High Demand and Growth Potential

High-demand virtual mental health clinic with $374K revenue, 12-20% revenue-share model, long waitlist, and strong growth potential via physician recruitment

Asking Price:

$109,409

Nov 27, 2025

Health and Beauty

Natural Hair Growth Ecommerce Store for Sale | High Demand Niche

D2C e-commerce business offering powerful, natural hair care solutions that fight hair loss, boost growth, and restore confidence with visible results.

Asking Price:

$63,159

Nov 27, 2025

Automotive

Car Seat Covers Dropshipping Store for Sale | High Profit Automotive Niche

Most Different Brands Car Seat Covers - DZX Cover business About $100K in revenue each order profit is about $100-$150

Asking Price:

$56,000

Nov 26, 2025

Lifestyle

POD Apparel Ecommerce Store for Sale | High Growth, Zero Inventory Risk

High-growth POD apparel brand with $534K revenue, 20% margins, 30%+ YoY growth, 384K users, and 44K subs., offering scalable operations and zero inventory risk.

Asking Price:

$100,000

Nov 26, 2025

Health and Beauty

Quit Snoring Ecommerce Store for Sale | High Margin and Scalable

70% profit margin, $43K revenue, $30K profit, 4,700+ customers, and 0% refund rate ~ scalable ecommerce brand in the booming sleep wellness market

Asking Price:

$56,170

Nov 26, 2025

Education

Online Education Business for Sale | Cacao and Spirituality Courses

Automated education store with 1,100 plus students and $122K revenue. Strong brand in the cacao and spirituality niche with solid growth potential.

Asking Price:

$89,964

Nov 24, 2025

Framer and Figma Design Library | Premium Web Design Assets Store

Fastest-growing Framer and Figma library crafted to simplify and elevate the web design process for creators of all skill levels

Asking Price:

$200,000

Nov 24, 2025

Design and Style

Designer Brand for Sale | Stylish In House Products and Strong Margins

Thriving up and coming Designer brand with impressive revenue and profit margin. Established in 2023, debt free and ready for growth!

Asking Price:

$135,000

Nov 20, 2025

Health and Beauty

Men’s Body Grooming Ecommerce Brand | High Profit and Growing Demand

A 14 -Month Old Ecommerce Brand, trimmer for body & underneath. Scaling in Norway|$690K Revenue $190K Net Profit|Ready for Q4. Digitally accessible worldwide.

Asking Price:

$119,900

Nov 18, 2025

Design and Style

Profitable Fashion Dropshipping Store for Sale | 1 Year Brand with €427K Revenue

Profitable fashion and design store earning €427K revenue and €106K profit with 25 percent margins. Over 20K customers and a strong subscriber list.

Asking Price:

$113,180

Nov 17, 2025

Sports and Outdoor

Reformer Pilates Equipment Ecommerce Brand | High-End DTC Equipment

High-Margin DTC Pilates Equipment Brand | Loyal Customer Base | Scalable Growth

Asking Price:

$168,797

Nov 17, 2025

Electronics

Electronic Dropshipping Store for Sale | Profitable Evergreen Niches

Profitable 100% Electronic Dropshipping store with $249K revenue, $75K profit, 30% margins, 3,800+ customers, and huge growth potential in evergreen niches

Asking Price:

$133,997

Nov 17, 2025

Design and Style

Fashion Ecommerce Brand | Profitable and Established

Fashion eCommerce brand| $523K Revenue | $173K Net | $60 AOV | 7.75% Returning Customers | 11300+ Email Sub

Asking Price:

$59,631

Nov 14, 2025

Home

8-Year Home & Garden Ecommerce Store for Sale | Hammocks & Outdoor Gear

8-Year-Old Shopify eCommerce Business Selling Hammocks & Outdoor Lounging Products ~27% Margins, Strong SEO & Loyal Customer Base

Asking Price:

$107,448

Nov 14, 2025

Business

Established HVAC Manufacturing Business | 40+ Years & Proprietary Products

Opportunity to acquire a 40+ year old, light manufacturing and resale business in the HVAC machinery industry. Proprietary product line. Truly a niche business!

Asking Price:

Sold

Nov 13, 2025

Health and Beauty

Profitable Wellness Brand | $66K/yr Revenue | 55% Margins

Profitable wellness eCommerce brand making $66K/yr with 55% margins, 30% repeat customers, and multi-channel revenue. Scalable, turnkey growth

Asking Price:

$59,292

Nov 11, 2025

Business

Trading Funding Platform | Scalable Model with Strong Demand

This platform offers innovative funding solutions for traders, providing fast and flexible virtual simulated capital to help traders.

Asking Price:

$700,000

Nov 11, 2025

Home

Waterworks Niche Dropshipping E-commerce Business for Sale

A highly profitable, drop shipping business in the waterworks industry, generating millions in revenue with minimal overhead and strong growth potential.

Asking Price:

$1,000,000

Nov 11, 2025

Design and Style

Luxury Pen E-commerce Business for Sale:

Premium pen brand with 99% YoY growth, strong margins, and $3.1M+ revenue, ready to scale with global IP, D2C and Amazon presence.

Asking Price:

$1,200,000

Nov 11, 2025

Design and Style

Biohacking Wellness Brand for Sale | High Profit DTC Wearable

Fast Growth DTC brand Wellness niche, generating $4.5M in revenue with a 25% profit margin in the last 12 months $220K PROFIT LAST 30 DAYS

Asking Price:

$2,000,000

Nov 10, 2025

Design and Style

Established Clothing E-commerce Brand | $160K Revenue, 93% Margins

Thriving eCommerce business in Design & Style industry with $160K revenue and 93% profit margin. Established in 2018 with strong growth potential.

Asking Price:

$26,084

Nov 10, 2025

Design and Style

Automated Fashion Shopify Store for Sale| Scalable and Low Overhead

Automated fashion brand with $230K revenue last 12 months, $49K profit, 30K email subs, 77K approved products, 20% SEO traffic, and strong growth levers

Asking Price:

$27,635

Nov 6, 2025

Polarized Sunglasses Ecommerce Business for Sale

Ecommerce of polarized sunglasses, the hype on this product is real and gonna make a lot of sales in next years

Asking Price:

$108,681

Nov 6, 2025

Design and Style

Activewear Business for Sale | Celebrity-Endorsed Brand at Stock Value

Activewear brand that has had global exposure. Quick sale for personal reasons at stock value only. Get the site, subscribers and A grade celebrity access free

Asking Price:

$66,122

Nov 6, 2025

Design and Style

Profitable Nurse Clothing Brand | Proven Demand & Engaged Audience

Profitable nurse clothing brand with $3.7M sales (2020-2024). Established community serving passionate professionals. Loyal customers, proven model.

Asking Price:

$95,850

Nov 6, 2025

Sports and Outdoor

Leading Online Padel Gear Shop in the UK | Steady Traffic & Loyal Customers

Leading online Padel retail businesses in the UK. Established relationships with leading Padel brands. Regular site traffic & customers, excellent reviews.

Asking Price:

$60,042

Nov 4, 2025

Electronics

Trendy Phone Cases Ecommerce Store | Turnkey E-commerce Setup

Trendy online phone accessary store with average $165K annual revenue and 70% profit margin since 2020. Turnkey store ready for scale and new ownership.

Asking Price:

$70,000

Nov 3, 2025

Electronics

Privacy-Focused Mobile Devices Store | Growing Privacy Market

E-commerce business for sale: Offers de-tracked devices and accessories. Runs on trusted privacy OS builds. Steady interest and room to scale.

Asking Price:

$70,000

Oct 31, 2025

Design and Style

Luxury Fashion Brand | Ready to Scale Worldwide

Luxury fashion brand with $115K annual revenue, 44% margins, $98 AOV, 7K IG followers, and huge untapped US/EU market growth potential

Asking Price:

$30,000

Oct 30, 2025

Lifestyle

Curated Smoke Accessories Ecommerce Brand | Strong Growth Potential

Profitable lifestyle eCom brand with $96K annual revenue, 22% margins, 6.3K email subs, 6.6K customers, and 2K+ organic keywordsprimed for scale

Asking Price:

$42,801

Oct 30, 2025

Design and Style

Hand-Designed Clothing Shopify Store | Established and Ready To Grow

Established in 2016, this profitable eCommerce business in the Design and Style industry boasts impressive revenue and a high-profit margin

Asking Price:

$89,731

Oct 30, 2025

Sports and Outdoor

Beach Gear E-commerce Brand | High Margins & Low Involvement

High-margin Australian Beach Brand eComm: 70% Gross Profit, 26% YoY Revenue, 31% Traffic Growth, $117 AOV. Multi-channel Sales, Low Owner Involvement

Asking Price:

$69,454

Oct 29, 2025

Design and Style

Established Fashion Ecommerce Store | Strong Margins & Ready to Scale

Established Fashion eCommerce business with $148k revenue and 28% profit margin ready for a new owner. Started in October 2024 ready to go next level during Q4!

Asking Price:

$100,000

Oct 29, 2025

Health and Beauty

At-Home Anti-Aging Face Device Ecommerce Brand

LumiBe offers anti-aging treatments and an innovative facial device to firm, smooth and brighten your skin naturally at home.

Asking Price:

$65,420

Oct 28, 2025

Hobbies and Games

Viral Cosplay Product E-commerce Brand With High Margins

48% margin viral D2C brand with $130K revenue, $63K profit, 2.1K customers, VA-run ops, and huge growth potential on TikTok and global markets

Asking Price:

$17,460

Oct 27, 2025

Home

Premium Portable Vacuum E-commerce Business for Sale

Scalable 7-figure eCommerce brand selling a premium portable vacuum with a high-converting funnel, proven paid ads strategy & a 100,000+ email lis

Asking Price:

$1,500,000

Oct 24, 2025

Electronics

High-Margin Tech Accessory E-commerce Brand | $10K+ Monthly Revenue & Automated

High-margin, automated store selling viral phone accessories with no ad costs and scalable potential.

Asking Price:

$70,000

Oct 23, 2025

Profitable Faith-based Apparel Brand | Unique Designs & Growth Ready

Profitable faith-inspired clothing brand with zero competition, unique designs, automated operations, and a loyal, engaged audience. High growth potential!

Asking Price:

$115,000

Oct 23, 2025

Gaming Console Shopify Brand | $270K Revenue & $145K Profit

A 1 year 5 month Old Organic Shopify Brand Selling Viral Gaming Console with $270K+ Revenue And $145k+ Profit. Automated Brand, Good For A First time Buyer.

Asking Price:

$43,000

Oct 22, 2025

Mental Health Ecommerce Brand | Profitable, Scalable & 100% Digital

An online mental health platform offering pre-recorded trauma therapy programs and CE courses for therapists and clients. Profitable, scalable and digital.

Asking Price:

$110,000

Oct 22, 2025

Profitable European Jewelry Shopify Brand | $185K Revenue, 33% Margins & Growth Ready

Profitable EU jewelry brand with 33% margins, $185K TTM revenue, 7K+ customers, and 3 localized Shopify stores primed for rapid expansion.

Asking Price:

$53,057

Oct 21, 2025

Vintage Cycling Apparel E-commerce Brand | $80K Profit & Loyal Customer Base

Profitable E-Commerce Business selling vintage cycling apparel and accessories | $80k+ Annual Profit | 25% Repeat Customers & 2.6x ROAS

Asking Price:

$100,000

Oct 17, 2025

Home and Garden

Water Treatment Products | Profitable Home & Garden Ecommerce Brand

Highly profitable e-commerce business. 45%+ margins with advanced water treatment products. Turnkey and ready for a new owner

Asking Price:

$89,287

Oct 16, 2025

Business

Ecommerce Business for Sale – Travel Products Brand

Ecommerce store specializing in the sale of travel-related products, with its flagship product being AirVenture, an air compression backpack.

Asking Price:

Sold

Oct 13, 2025

Home and Garden

Outdoor & Travel Gear Ecommerce Brand | $658K Sales, $114K Profit

A Year Old Dropshipping Store Selling Outdoor & Travel Gear | $658K Revenue $114K Profit. Ready To Scale

Asking Price:

$70,000

Oct 10, 2025

Health and Beauty

Fast-Growing Leg Shaver Store | $118K Profit & $707K Revenue

An Approaching 1 Year Old Beauty Store Selling Leg Shavers. Impressive Revenue Exceeds $707k Whilst NETTING a Profit Of $118k. Steady Growth & Healthy Margins

Asking Price:

$110,000

Oct 8, 2025

Design and Style

Scandinavian ShapeWear E-Commerce Brand

Profitable Scandinavian e-commerce brand in Design & Style. $130k revenue, 32% margin. Established 2024. Ready to scale ahead of Q4 2025.

Asking Price:

$69,000

Oct 7, 2025

Business

Profitable BJJ Gear E-Commerce Store | $290K Revenue, 40% Margins

Profitable eCom brand in BJJ gear with $290K TTM revenue, 40% margins, loyal customers, SEO-driven sales, and strong growth opportunities

Asking Price:

$40,000

Oct 6, 2025

Business

Profitable eSIM Business for Sale | 13K+ Customers, $200K Sales

Ready-to-Go eSIM Business with 13K+ Customers & 200K SalesYour Passive Income Gem

Asking Price:

$120,000

Oct 6, 2025

Food and Drink

Profitable UK Chocolate Brand | $20K–$80K Monthly Revenue

Highly profitable UK based Sex chocolate brand. Trademarked, making 20,000-80,000 per month in rev. Looking to sell pre Q1 (valentines day)

Asking Price:

$63,757

Oct 3, 2025

Sports and Outdoor

Profitable Golf Simulator E-commerce Store | High-Ticket E-commerce

Profitable golf simulator eCommerce store with strong branding, high-ticket sales, and immense growth potential. Established revenue, ready to scale.

Asking Price:

$110,000

Oct 1, 2025

Automotive

Digital Automotive Insurance Products Shopiy Store for Sale (99% Profit)

99% margin digital product with $100K annual revenue, 8K+ customers, 0% refunds, and 162K sessions ~ all organic, leaving major scaling upside

Asking Price:

$209,637

Sep 30, 2025

Sports and Outdoor

Soccer Gear For Fans & Clubs Turnkey Shopify Business

A 5 year old e-commerce company specializing in soccer merchandise for clubs, supporters groups and fans, including jerseys, hats, jackets, scarves, and more.

Asking Price:

$285,000

Sep 30, 2025

Health and Beauty

Profitable Health And Beauty E-commerce Store|$143,640 Annual Profit

Established eCommerce store in Health & Beauty industry with $748K revenue & 16% profit margin. Includes strong domain authority.

Asking Price:

$170,000

Sep 23, 2025

Design and Style

Market-leading Jewelry Shopify Store

Profitable jewelry store with 50+ products, high margins, and solid AOV. Shopify Store for Sale.

Asking Price:

$100,886

Sep 22, 2025

Design and Style

Customized Posters E-commerce Business for Sale

Custom poster store founded in 2021 offering design and digital prints. Online E-commerce Business for Sale.

Asking Price:

$100,618

Sep 18, 2025

Lifestyle

Smoke Accessories Shopify Store (Dropshipping Fulfillment Model)

Profitable lifestyle eCom brand with $96K annual revenue, 22% margins, 6.3K email subs, 6.6K customers, and 2K+ organic keywordsprimed for scale

Asking Price:

$101,438

Sep 18, 2025

Pets

Pet Niche Online Business for Sale

A 16-year-old online business is well established & operating in South Africa, USA, UK and EU.

Asking Price:

$35,810

Sep 5, 2025

Automotive

Motorsport-Inspired Apparel E-commerce Business for Sale

Premium motorsport-inspired clothing brand. Easy to manage and scale.

Asking Price:

$90,000

Sep 4, 2025

Health and Beauty

Hydrogen Water Bottle E-commerce Business for Sale

An Approaching 2 Year Old Wellness Brand Selling Hydrogen Water Bottles. A Total Revenue Of $2.1M With A NET Of $364k. Ready To Expand Into New Products

Asking Price:

$149,999

Sep 3, 2025

Design and Style

Fully Automated Dropshipping Business (Fashion, Home Decor, Gadgets)

This 1-year-old store is fully automated and operates in the fashion, gadgets and home decoration niche.

Asking Price:

$100,000

Sep 3, 2025

Health and Beauty

Tanning Gummies E-commerce Business for Sale

Fast-Growing Supplement Brand Selling Tanning Gummies | $423K Total Revenue | $223K Total Profit | Ready to Scale

Asking Price:

$70,000

Aug 27, 2025

Health and Beauty

Perfume E-commerce Business for Sale

Over 1200 references including perfumes and beauty products (creams, lotions, etc.).

Asking Price:

$209,146

Aug 27, 2025

Lifestyle

Wellness D2C Shopify Store for Sale

A Wellness Brand Running In The Italian Market. Over 609k Revenue | 146k NET Profit. Ready For Summer Scale

Asking Price:

$139,113

Aug 25, 2025

Business

Automated Digital Music E-commerce Business for Sale

95% automated digital music brand earning $55K profit/year, 43% margins, 65K+ customersturnkey, fast-growing, and primed for scalable expansion

Asking Price:

$215,000

Aug 25, 2025

Health and Beauty

Established E-commerce Business for Sale (Home Fragrance Products)

Established in 2022, this Health and Beauty eCommerce business boasts strong revenue and a profitable 30% profit margin in the industry.

Asking Price:

$114,676

Aug 8, 2025

Design and Style

Jewelry Dropshipping Shopify Store for Sale

A High Margin Jewelry Store Running In Untapped Australian Market. Total Revenue Exceeds $1.8M USD With A NET of $453k USD. Consistent Growth

Asking Price:

Sold

Aug 8, 2025

Health and Beauty

Beauty Technology E-commerce Business for Sale

Established beauty brand with almost 260k in Sales generated with Facebook ads with high ROAS. ~150k only in the last 4 month. Huge front-end response.

Asking Price:

$83,977

Aug 7, 2025

Design and Style

Women's Fashion E-commerce Business for Sale

4 yr old e-commerce business in selling women's clothes & accessories, generating $100k+ annual revenue with 60% profit margin, strong brand & growth potential.

Asking Price:

$163,801

Aug 7, 2025

Health and Beauty

Fully Automated Skincare Shopify Business for Sale

Diversify your income with a fully automated beauty brand. High entry barrier, cheap ads, stock included. Seize this chance to tap into a booming EU market!

Asking Price:

$90,000

Aug 5, 2025

Baby

Premium Baby Products Shopify Store for Sale

This brand offers premium baby products, including strollers and car seats, through a Norway-based e-commerce store with global expansion potential.

Asking Price:

$98,699

Aug 5, 2025

Lifestyle

Interactive Kids Painting Kit E-commerce Business for Sale

A 1+ Year Old Kids Interactive Painting Kit Store Running In The U.S Market. A Total Revenue Of $1.1M With a NET Profit Of $190k. Ready To Expand Into New SKUs

Asking Price:

$115,000

Jul 31, 2025

Health and Beauty

Fragrance E-commerce Business for Sale

Profitable DTC pheromone fragrance brand with $1.26M TTM revenue, 80K+ emails, viral ads, and turnkey fulfillment.

Asking Price:

$78,997

Jul 30, 2025

Home and Garden

Coffee Niche Established E-commerce Business for Sale

Established global eCommerce brand operating in AU, NZ, UK, EU & CA. Automated UK 3PL setup. Key player in AU market. Simple and scalable.

Asking Price:

$141,571

Jul 30, 2025

Design and Style

Jewelry Dropshipping-Based E-commerce Business for Sale

A 1+ Year Old Jewelry Business Running In The Spanish Market. Total Revenue $459k With A NET Profit Of $127k. Ready To Be Further Scaled With New Products

Asking Price:

Sold

Jul 29, 2025

Home and Garden

Profitable Home Decor E-commerce Business for Sale

A 1+ Year Old Home Decor + Accessories Store Selling In The U.S. Over $4.6M In Total Revenue With A NET Profit Of $652k. Ready To Be Scaled Into New Markets.

Asking Price:

$265,000

Jul 29, 2025

Health and Beauty

Profitable, Low-Maintenance E-commerce Brand for Sale

A low maintenance, long running, consistent, and profitable brand with lots of room for growth and optimization

Asking Price:

$45,000

Jul 25, 2025

Health and Beauty

High-quality Beauty Product E-commerce Business for Sale

High-quality beauty product, delivered efficiently across 15 Countries in Europe with a seamless cash on delivery experience.

Asking Price:

$248,087

Jul 25, 2025

Electronics

Mobile Tech Solutions E-commerce Business for Sale

PROFITABLE + ROOM FOR GROWTH We sell mobile tech solutions to the Australian and New Zealand market, servicing digital nomads, and travelling professionals.

Asking Price:

$40,000

Jul 22, 2025

Design and Style

Fully Automated Fashion Dropshipping Shopify Store for Sale

A 1+ Year Old Fully Automated Dropshipping Fashion Store In Australia. Total Revenue $1.8M USD With A NET Of $366k. Running On Google Ads Only

Asking Price:

$149,999

Jul 22, 2025

Design and Style

iPhone/iPad Cases Dropshipping E-commerce Business for Sale

Easy to operate, low return rate, high proven grow potential, 1.5yrs old DropshippingShopify Store for Sale. 67K+ followers and low return rates. Easy to run.

Asking Price:

$35,000

Jul 19, 2025

Health and Beauty

High-quality Haircare Tools E-commerce Business for Sale

Revolutionizing Hair Care with High-Quality, Affordable Tools $438K Annual Revenue & 40% Profit Margins

Asking Price:

$112,878

Jul 19, 2025

Design and Style

Mens Gymwear Dropshipping Shopify Store for Sale

A 2+ Year Old Branded Dropshipping Store Selling Gym Related Jewelry. Total Revenue Exceeds $535k With A NET Profit Of $140k. Ready To Be Scaled Further

Asking Price:

$80,000

Jul 16, 2025

Hobbies and Games

Collectibles (Pressed Pennies) E-commerce Business for Sale

2X 5yrs old Community content site + Shopify & marketplace eCommerce business in Collectibles Niche, Making $1,386/m in Net Profit from Shopify, Etsy and Ebay

Asking Price:

$42,000

Jul 15, 2025

Health and Beauty

Health And Wellness E-commerce Business for Sale

A Profitable Wellness Business in the French Market with Patented Products. 1.06M Revenue | 174k Net Profit. Strong Growth Potential

Asking Price:

$174,173

Jul 15, 2025

Design and Style

Calming Sensory Niche E-commerce Business for Sale

A 1 year Old Organic Shopify Brand Selling Viral Home Decor Balls. $282K+ Revenue With $163k+ Profit. Automated Brand With Huge Potential To Scale Long Term

Asking Price:

$49,999

Jul 14, 2025

Health and Beauty

Arabic Perfumes E-commerce Business for Sale

EmanarBeauty.com Review: E-commerce Business for Sale. Beauty brand with $1.2M revenue, $146K profit, and wide reach.

Asking Price:

$228,443

Jul 10, 2025

Electronics

Bitcoin Lottery Miner Tech Ecommerce Business for Sale

Premier global retailer of Bitcoin lottery miners! Top SEO performance, Google Ads, thriving TG community & excellent X follows. Great potential to expand quick

Asking Price:

$50,932

Jul 9, 2025

Business

Digital Disconnection Accessories B2C/B2B Shopify Store for Sale

B2C & B2B Personalized Promotional Products - Emerging Product Category - Shopify - Seen in major publications - Klaviyo e-mail integration - Affiliate program

Asking Price:

Sold

Jul 1, 2025

Home

Luxury Furniture E-commerce Business For Sale

Online furniture Brand with huge potential 1.1 Million in Revenue!

Asking Price:

$135,740

Jul 1, 2025

Fitness

Customizable Fitness Templates Fitness Shopify Store for Sale

$415K Revenue | $5K Monthly Profit | 3K+ Subs | 2 Yrs Old | Shopify + Etsy | Plug & Play Fitness Brand with Passive Income

Asking Price:

$71,434

Jun 30, 2025

Education

Automted Educational Digital Products E-commerce Business for Sale

Military online business with strong organic traffic, 20K+ email list, and 260K+ social following. Premium digital products. Automated, low time commitment.

Asking Price:

$141,169

Jun 30, 2025

Pets

Calming Dog Beds for Dogs Pet Shopify Store for Sale

Acquire a thriving pet e-commerce business with a strong SEO presence and established customer base across multiple markets

Asking Price:

$59,000

Jun 24, 2025

Home

Handcrafted Home Decor Products Shopify Brand for Sale

Automated Home Decor E-commerce Brand | 3PL Fulfillment | A$11,750+ Avg Monthly Profit | A$1M+ Record Revenue Year | Scalable Growth Potential

Asking Price:

$127,275

Jun 24, 2025

Education

Business Documentation Digital Products Shopify Store for Sale

Profitable digital product store with 13,000+ assets & 10K+ customers. Fully automated, high margins & massive scale potential. 100% digital. Built on Shopify.

Asking Price:

$59,000

Jun 24, 2025

Business

Film Effects Resources Ecommerce Business for Sale

They offer downloadable cinematic effects and visual assets for filmmakers, enhancing video projects with high-quality resources.

Asking Price:

$30,741

Jun 20, 2025

Design and Style

Wooden Watches Shopify Store for Sale:

A 5-year-old Shopify store specializing in wooden watches, consistently generating profits with a steady growth rate. A beginner-friendly jewelry store.

Asking Price:

$248,209

Jun 20, 2025

Design and Style

High ROI Tattoo Digital Shopify Store for Sale

High-ROI Digital Tattoo E-commerce | Easy to Manage, Built to Scale

Asking Price:

$60,035

Jun 20, 2025

Health and Beauty

High-Quality Beauty Product E-commerce Business for Sale

High-quality beauty product, delivered efficiently across 15 Countries in Europe with a seamless cash on delivery experience.

Asking Price:

$248,087

Jun 18, 2025

Business

Pest Control Courses Shopify Store for Sale

Established Pest Control Certification Platform with 76% Profit Margins.

Asking Price:

$82,985

Jun 17, 2025

Health and Beauty

Customizable Print on Deamand Jewelry Shopify Store for Sale:

This 18-month store selling print on demand jewellery, earning $ 4 800 on average per month in the last 12 months.

Asking Price:

$143,640

Jun 17, 2025

Hobbies and Games

Digital Products E-commerce Business for Sale

Sells digital goods, focuses on instant delivery and competitive prices, ensuring customer satisfaction and security in every transaction.

Asking Price:

$60,135

Jun 16, 2025

Business

Interior Design Digital Products Shopify Store for Sale:

Profitable 3-year-old digital products store for designers. $576K+ revenue, high margins, no shipping costs. Turnkey Shopify Store for Sale.

Asking Price:

$99,450

Jun 12, 2025

Fashion

Print On Demand T-shirts Shopify Store for Sale:

Profitable 12-month-old dropshipping business with $33k annual profit, 13k Instagram followers, millions of organic views, and zero ad spend. Easy to run, high

Asking Price:

$27,687

Jun 10, 2025

Health and Beauty

LED Devices for Skincare Shopify Store for Sale:

2 years SEO business, selling innovative LED devices and serums for skincare worldwide, directly to the customer's home. High margin and high perceived value.

Asking Price:

$25,000

Jun 2, 2025

Hobbies and Games

Fully Automated Digital Products Shopify Store for Sale:

95% Passive Income Shopify Store Selling Unique Digital Products on Autopilot | 2 hours/week commitment | Turnkey store. Ideal investment for beginners

Asking Price:

$13,500

May 29, 2025

Design and Style

Profitable Canadian Fashion Ecommerce Brand for Sale

A Young & Exciting Fashion Store Running In The CA Market. Over $185k Revenue | $42k NET Profit. Ready For Summer Scale

Asking Price:

$30,000

May 29, 2025

Health and Beauty

High-quality Women Perfume Shopify Store for Sale:

Ecommerce business for sale offering high-quality, 10ml roll-on perfumes for women. Made and certified in Germany, ensuring premium,long-lasting scents in a compact, elegant design

Asking Price:

$676,999

May 26, 2025

Education

Kids Education Shopify Store for Sale

7-month store with inside a collection of workbooks of different topics that prepare and educate children for elementary school. All products are 100% digital.

Asking Price:

$11,475

May 22, 2025

Jewelry

Jewelry Shopify Store for Sale

An 8 Month Old Jewelry Business Running In The Canadian Market. Total Revenue $187k With A NET Profit Of $48k. Ready To Be Further Scaled With New Products

Asking Price:

Sold

May 21, 2025

Pets

Pet Memorabilia PoD Ecommerce Business for Sale:

$738K Revenue | 82% Margins | Featured in INC, NY Post & More | The Ultimate POD Brand!

Asking Price:

$160,000

May 21, 2025

Home

Turnkey Air Purifier E-commerce Business for Sale

Turnkey air purification business in Thailand: Patented and Trademarked e-commerce with inventory included. Great deal for any investor

Asking Price:

$65,000

May 20, 2025

Fashion

Profitable Fashion Shopify Store for Sale

Fast-growing US fashion brand in a top niche. Huge upside and scalability. Profitable Shopify Store for Sale.

Asking Price:

$450,000

May 20, 2025

Pets

Cold Weather Pet Accessories Shopify Store for Sale

Own a Proven $25K/Month Seasonal DTC Brand With 6,000+ Customers & $100K+ in Revenue & $63,000 USD Net Profit.

Asking Price:

$25,000

May 19, 2025

Home

Handcrafted Game Table E-commerce Business for Sale

Profitable niche eCommerce business, offering handcrafted game tables with high margins and minimal overhead. Potential for significant growth!

Asking Price:

$62,292

May 16, 2025

Health and Beauty

Digital Tarot & Psychic Readings Ecommerce Business for Sale

A Profitable Digital Tarot & Psychic Readings Brand in the US. $1.39M Revenue | $350K NET Profit. Fully Automated & Scalable

Asking Price:

$950,000

May 16, 2025

Design and Style

Rap-Niched Jewelry Shopify Dropshipping Store for Sale

An Organic 5-month-old Shopify Dropshipping Store Selling Rap Niched Jewellery With $42K+ In Revenue

Asking Price:

$20,000

May 13, 2025

Design and Style

Designer E-commerce Brand For Sale

Thriving up and coming Designer brand with impressive revenue and profit margin. Established in 2023, debt free and ready for growth!

Asking Price:

$285,503

May 13, 2025

Design and Style

Winterwear Shopify Store for Sale

Comfort meets style in this winter wear brand, offering cozy essentials designed to keep you warm and fashionable during the chilliest months of the year!

Asking Price:

$320,000

May 12, 2025

Design and Style

Swimwear E-commerce Business for Sale

Fast-growing swimwear brand with recognized name in the industry. An incredible opportunity to step into a premium brand with a proven track record of success.

Asking Price:

$400,000

May 12, 2025

Home

Home & Garden Dropshipping Shopify Store for Sale

Innovative Home & Garden brand with dropshipping, POD, & direct shipping. Profitable E-commerce Business for Sale, leveraging Shopify & Printful.

Asking Price:

$342,705

May 9, 2025

Health and Beauty

Digital Spiritual Products Shopify Store for Sale

Profitable metaphysical Shopify store offering digital & spiritual products. Over $600K in lifetime revenue, $400K+ net profit, organic traffic, low overhead.

Asking Price:

$160,000

May 9, 2025

Design and Style

Automated Men's Fashion E-commerce Business for Sale

Profitable eCommerce business in the Men's Designer industry with $450-500k revenue. The Business is semi-automated and has incredible potential to scale.

Asking Price:

$399,999

May 8, 2025

Health and Beauty

Beauty Shopify Store for Sale

Reusable lashes that go on in seconds - branded dropshipping store in the beauty niche.

Asking Price:

$599,999

May 8, 2025

Health and Beauty

Salon-Grade Haircare Products E-commerce Business for Sales

Profitable online beauty biz w/ $350K inventory, 37K+ orders, 2 brands on Walmart & eBay. Easy to run, scalable, turnkey, with strong net income.

Asking Price:

$276,250

May 7, 2025

Fashion

Affordable Women Fashion Shopify Store for Sale

1.4M EUR revenue over the past 12 months, with an average monthly profit of 25K EUR. Highly automated, minimal effort to run with growth potential

Asking Price:

$647,728

May 7, 2025

Health and Beauty

Self-Tanning Supplement E-commerce Business for Sales

A High-Growth Self-Tanning Brand in the US Market. $1.2M Revenue | $336K NET Profit. Strong Expansion Potential

Asking Price:

$800,000

May 6, 2025

Health and Beauty

Wellness E-commerce Brand for Sale

A Booming $1.48M-Valued E-Commerce Wellness Brand Priced Below Market Value Rare Opportunity to Acquire a Scalable Pain Relief Business!

Asking Price:

$682,000

May 2, 2025

Health and Beauty

Beauty E-commerce Business for Sale

Profitable eCommerce beauty brand, est. 2022, $1M+ revenue, 15%-50% margin. Huge growth potential for buyers with organic & paid media expertise.

Asking Price:

$350,000

May 2, 2025

Home

Home & Garden E-commerce Business for Sale

Profitable eCommerce business in Home & Garden. 3M revenue over 4 years, 700K in 12 months, 30% profit margin. Est. 2021, DA 9

Asking Price:

$331,634

Apr 30, 2025

Home

Bedding E-commerce Business for Sale

A stable and dominant bedding brand with a focus on the Baltic market in the bedding niche with ample opportunity for expansion

Asking Price:

$720,041

Apr 30, 2025

Design and Style

Digital Tattoo E-commerce Business for Sale

High-ROI Digital Tattoo E-commerce | Easy to Manage, Built to Scale

Asking Price:

$79,285

Apr 30, 2025

Health and Beauty

Beauty E-commerce Business for Sale

3 year old Beauty Brand, generating $1.7M in annual revenue with Impressive 22% profit margin. Expansion to the U.S. market already prepared and ready to launch

Asking Price:

$880,508

Apr 29, 2025

Business

NFC Devices Shopify Store for Sale:

An 18-month-old Shopify brand selling NFC devices to help retail businesses collect Google reviews. 50% profit margin. Last 12 months: 200k+ revenue.

Asking Price:

$88,613

Apr 28, 2025

Health and Beauty

Customizable Receipe Books E-commerce Business for Sale

We provide customizable recipe books and evidence-based educational materials for nutritionists and coaches to enhance client engagement and streamline services

Asking Price:

$142,500

Apr 28, 2025

RPG & Fantasy Niche E-commerce Business for Sale

Highly Profitable Digital Business in the RPG & Fantasy Niche Avg. 8K Net Profit/Month | Worldwide Market

Asking Price:

$49,124

Apr 23, 2025

Home

Lighting Brand E-commerce Business for Sale

Lighting brand generating $1.2M+ annually with streamlined operations, outsourced support, and major growth potential via new products and expanded marketing.

Asking Price:

$475,000

Apr 22, 2025

Auto Data E-commerce Business for Sale | The Auto Experts Review:

Auto Experts is a UK-based data business offering car history checks, targeting 40M drivers and 18,000+ dealers, with up to 85% EBITDA and efficient processes.

Asking Price:

$121,761

Apr 22, 2025

Health and Beauty

Wellness Digital Product E-commerce Business for Sale

Personalized quit smoking plan based on the customer smoking habits. Digital product that contains personalized plan and custom made meditations in 10 languages

Asking Price:

$26,834

Apr 22, 2025

Fashion

Faith-Based Apparel Shopify Store for Sale

Profitable faith-inspired clothing brand with zero competition, unique designs, automated operations, and a loyal, engaged audience. High growth potential!

Asking Price:

$115,000

Apr 18, 2025

Health and Beauty

Medical Equipment Shopify Dropshipping Business for Sale

Profitable, low-maintenance Shopify dropshipping business in a recession-proof industry with $1.4M revenue, strong growth potential, & minimal time commitment.

Asking Price:

$350,000

Apr 17, 2025

Digital Productivity Templates E-commerce Business for Sale

Templates for Productivity is a profitable e-commerce store selling premium digital templates for reMarkable users. Scalable, high-margin, and primed for growth

Asking Price:

$58,203

Apr 17, 2025

Toy E-commerce Company for Sale

High-Performance Designer Toy Brand: $670K Revenue, 25% Profit Margin, 3.2x ROAS, Exclusive Licensing Deals

Asking Price:

$119,585

Apr 16, 2025

Highly Profitable Digital Product E-commerce Business for Sale

Highly profitable Digital Product Business selling educational e-books and courses related to social media

Asking Price:

$59,000

Apr 14, 2025

DIY Woodworking E-commerce Business for Sale

E-commerce in the DIY woodworking niche offering a digital product, the DIY Master Pack, featuring 100+ woodworking plans. Fully scalable and ready to grow.

Asking Price:

$140,816

Apr 11, 2025

Health and Beauty

DTC Alcohol Flush Solution E-commerce Company for Sale

Category-Leading DTC Brand offering alcohol flush solutions |$1.5M Revenue & 36% repeat customers |Scalable e-commerce & Amazon expansion.

Asking Price:

$403,782

Apr 11, 2025

Home

Home Decor E-commerce Business for Sale

Offers a wide selection of easy to clean, machine washable rugs online, focusing on quality materials and diverse styles to suit various home decor needs.

Asking Price:

Sold

Apr 10, 2025

Fitness

Supplement E-commerce Business for Sale | FlexAgain Review:

This joint supplement business has consistent returns and generated $270K revenue Feb 24 - Jan 25 with net profit $185K. Loyal customer based and strong margins

Asking Price:

$700,000

Apr 10, 2025

Fashion

Fashion Dropshipping Shopify Business for Sale

A 12-Month-Old British Dropshipping Store With 1.8M In Revenue Utilizing Google Ads

Asking Price:

$359,809

Apr 8, 2025

Retro Film Lenses E-commerce Brand for Sale

An Exceptionally Growing E-commerce Brand Selling Retro Film Lenses With $689K Revenue And $120,000+ Profit

Asking Price:

$120,000

Apr 7, 2025

Fashion

Print-On-Demand Clothing E-commerce Business for Sale

Ready to scale print-on-demand clothing brand for viral finance and internet culture merchandise. Strong organic growth, no ad spend, low maintenance.

Asking Price:

$56,451

Apr 7, 2025

Fashion

Fashion E-commerce Business for Sale

A 2-year old Ecom in Fashion industry that offers footwear and clothes. Has $315k annual revenue with 20% profit margin and $173 AOV.

Asking Price:

$59,000

Apr 4, 2025

Fashion

Athleisure E-commerce Business for Sale

Athleisure brand offering exceptional quality for women's and mens activewear. Specializing in Leggings, sports bras, Joggers, T-shirts, & Hoodies.

Asking Price:

$67,696

Apr 4, 2025

Kitchen

Cookware E-commerce Business for Sale

Home Impex US Inc. is the exclusive distributor of Berlinger Haus in North America, offering European-designed cookware to revolutionize American kitchens.

Asking Price:

$98,000

Apr 3, 2025

Health and Beauty

Salom-Quality Gel Nails E-commerce Business for Sale

Gelled Nails is an innovative beauty product that allows you to have salon-quality gel nails at home in 10 minutes, being an effective and affordable alternative

Asking Price:

$328,652

Apr 2, 2025

Health and Beauty

Skincare E-commerce Business for Sale

We help women achieve youthful, glowing skin effortlessly with our premium collagen masks.

Asking Price:

$450,000

Apr 1, 2025

Home

Home Decor E-commerce Business for Sale

Highly profitable - home decor eCommerce store - impressive revenue and profit margin. - Massive growth opportunity. Don't miss out on this opportunity!

Asking Price:

$131,564

Apr 1, 2025

Home

Scandinavian-Inspired Home Decor Shopify Store for Sale

An online store specializing in stylish Scandinavian-inspired home decor and lighting, offering high-quality products for a modern and minimalist aesthetic

Asking Price:

$110,590

Mar 31, 2025

Fashion

Womens Fashion E-commerce Business for Sale

Profitable womens fashion brand with $101,810/month revenue, 500 units of inventory, 8,463 email subscribers, and all brand assets included.

Asking Price:

$100,000

Mar 31, 2025

Fashion

Home E-commerce Business for Sale

A 1 Year Old Home Store Selling In the U.S. Market Mainly. Over $1.78M in Revenue With $250k+ NET Profit Generated. Ready To Scale For 2025

Asking Price:

$65,000

Mar 28, 2025

Fashion

Clothing E-commerce Business for Sale

Ecommerce Clothing brand with hundreds of orders & tens of thousand followers worldwide with very high engagement! Huge scale potential

Asking Price:

$58,900

Mar 28, 2025

Health and Beauty

Motorcycle-Themed Jewelry Dropshipping Store for Sale

This is a great opportunity to enter a truly Turnkey Jewelry E-commerce dropship website before the major holiday season starts. Re-coup your investment fast!

Asking Price:

$148,000

Mar 27, 2025

Fashion

Branded Fashion Dropshipping Shopify Store for Sale

Cristian Moretti, A 1.7-Year-Old Branded Fashion U.S. Dropshipping Store. Over $1M Revenue Generated With $166K NET Profit. Scaling on Facebook Ads

Asking Price:

$129,999

Mar 27, 2025

Health and Beauty

Biodegradable Skincare Wipes E-commerce Business for Sale

RECESS, Female-founded 6-year-old on-the-go skincare brand featuring biodegradable hair, body, + face wipes. We have happy customers, and upside w/the right support.

Asking Price:

$135,000

Mar 26, 2025

Health and Beauty

At-home Hair Straightening Kits E-commerce Business for Sale

Yousbeauty is profitable e-commerce brand offering at-home hair straightening kits. Strong margins, recurring customers, and high-growth potential in a sustainable niche.

Asking Price:

$173,362

Mar 26, 2025

Health and Beauty

Acne Treatment E-commerce Business for Sale

Established eCommerce business in the skincare and Beauty industry with $520K revenue and 46% profit margin. Trusted acne skincare expert!

Asking Price:

$900,000

Mar 25, 2025

Home

Sustainable Cleaning E-commerce Business for Sale

Australian-based sustainable cleaning brand established in 2021. Based in the eco-friendly homecare market. Boasts 85% customer repeat rate and growing subscription revenue stream.

Asking Price:

Sold

Mar 25, 2025

Health and Beauty

Magnetotherapy Dropshipping Shopify Store for Sale

Magnetotherapy Dropshipping E-Commerce with a Scalable Model and Guaranteed Performance!

Asking Price:

$173,278

Mar 24, 2025

Health and Beauty

Male Grooming E-commerce Business for Sale

A 1.8 Year Old Male Grooming Brand Running In The Australian Market. Total Revenue $870k USD | Total Net Profit $138k USD | Monthly Subscription With $6k USD

Asking Price:

Sold

Mar 24, 2025

Baby

Handmade Baby Decor E-commerce Business for Sale

eCommerce store selling handmade baby mobiles with healthy profit margins and plenty of opportunity for growth.

Asking Price:

$145,000

Mar 19, 2025

Health and Beauty

Skincare E-commerce Business for Sale

5 y/o award-winning skincare brand with a strong organic loyal customer base and features in publications including Harpers Bazaar and Vogue.

Asking Price:

$160,772

Mar 19, 2025

Health and Beauty

Health & Beauty E-commerce Business for Sale

We offer 7 different products, from $250-$29 the main product is the most expensive and the cheapest are the consumable products that our buyers repurchase.

Asking Price:

$600,000

Mar 18, 2025

Health and Beauty

Beauty Niche E-commerce Business for Sale

e-commerce business for sale in beauty niche. $1M+ sales, 23% net profit, and $120 AOV. Scalable, profitable, and growth-ready!

Asking Price:

$251,505

Mar 18, 2025

Fashion

Anime Streetwear Brand Shopify Store for Sale

Kuttn is a clothing brand bridges the gap between anime merch and aesthetic, high-quality clothing. Embroidery is stitched onto the hood to create unique pieces

Asking Price:

$200,000

Mar 14, 2025

Health and Beauty

Profitable E-commerce Business for Sale

Profitable Fragrance eCommerce business with Stable revenue & profit margins. Established in 2023 with a solid online presence. High Scalability Potential.

Asking Price:

$64,800

Mar 14, 2025

Health and Beauty

GMP-Certified Gummies Shopify Store for Sale

Made in USA | GMP Certified Gummies for Him & Her | $587K in Revenue TTM | Tons of Growth Opportunity | Automated Influencer Recruiting Tool

Asking Price:

$325,520

Mar 12, 2025

Health and Beauty

Mental Health Niche E-commerce Business for Sale

Very easy to maintain, mental health niche, huge opportunity and growth, 13% Returning rate & paid monthly subscriptions.

Asking Price:

Sold

Mar 12, 2025

Fashion

Italian Fashion E-commerce Business for Sale

Investment Proposal: 50% Equity on Full Brand Assets / Full Buyout -- Proven Experience in E-commerce ($7M+ rev)

Asking Price:

$100,000

Mar 7, 2025

Home

Mattress E-commerce Business for Sale

A market disruptor in the home & living space, an all-in-one mattress that recharges, supports and cools. LTM Multiple: 2.6x

Asking Price:

$734,754

Mar 6, 2025

Home

Kitchen Tools E-commerce Business for Sale

Our Hero Product is a Rotary Cheese Grater, we have other upsell products that we sell as well in the kitchen niche.

Asking Price:

$150,000

Mar 4, 2025

Capybara Plushies Shopify Store for Sale

A 16-month-old Shopify E-commerce brand selling Capybara plushies with over $750k in revenue. Huge potential

Asking Price:

$55,000

Mar 4, 2025

Health and Beauty

Self-care & Sexual Wellness E-commerce Business for Sale

Quanna is a premium self-care and sexual wellness brand with presence in the UK and USA.

Asking Price:

$155,709

Mar 3, 2025

Health and Beauty

Premium Oral Hygiene E-commerce Business for Sale

A thriving oral hygiene brand with 150k+ customers, high returning customer rate, and premium product offerings. Scalable, with strong global growth potential.

Asking Price:

$280,000

Mar 3, 2025

Health and Beauty

Eco-Friendly Shopify Store for Sale

Offers eco-friendly, innovative relaxation products, focusing on sustainability and customer well-being for a more mindful lifestyle.

Asking Price:

$250,000

Mar 3, 2025

Health and Beauty

Premium Skincare E-commerce Brand for Sale

Rapidly growing U.S.-based skincare brand with $2M in revenue & $600K in Total Net profit. Custom-formulated products, loyal customers, and massive expansion potential

Asking Price:

$490,000

Feb 28, 2025

Health and Beauty

Red Light Therapy Skincare E-commerce Business for Sale

A 1 Year Old Red Light Therapy Skincare Brand. Total Revenue $1.33M | Total Net Profit $289k | Ready To Be Scaled Into New Markets & Similar SKUs

Asking Price:

$250,000

Feb 28, 2025

Fashion

Automotive-Inspired Luxury Watches Shopify Store for Sale

Established in 2020. Branded Dropshipping Store with improved products and unique designs. Efficient deals with private agent.

Asking Price:

$55,000

Feb 26, 2025

Fashion

Luxury Eyewear Shopify E-commerce Store for Sale

Profitable e-commerce brand with $712,903 TTM revenue and $247,341 TTM profit specializing in luxury eyewear.

Asking Price:

Sold

Feb 26, 2025

Jewelry

Jewellery E-commerce Business for Sale

Profitable Jewellery eCommerce business established in 2020 with $691K revenue, 30% profit margin. Ready to flourish!

Asking Price:

$421,000

Feb 26, 2025

Motorsport-Inspired Apparel Ecommerce Business for Sale

A premium motorsport-inspired apparel brand, easy to manage and run.

Asking Price:

$90,000

Feb 24, 2025

Sports and Outdoor

Jumpy Rope Ecommerce Store for Sale

Turnkey eCommerce business for sale! BoxRope generates $771K/year with 25% profit margin. Automated operations & strong D2C presence. Priced at $1M.

Asking Price:

$1,000,000

Feb 24, 2025

Custom Stickers Shopify Business for Sale

Profitable eCommerce business with $307K revenue, $64K profit, 21% margin, and 187% growth in 2024. High-quality custom stickers and strong customer base.

Asking Price:

$105,555

Feb 21, 2025

Financial Savings E-commerce Business for Sale

A 11-Month-Old U.S. Dropshipping Business Selling Financial Savings Products & Tools with $3.3M in Revenue and $380k+ in Net Profit. Customer List Exceeds 87k

Asking Price:

$265,000

Feb 20, 2025

Fashion

Car Fashion Niche E-commerce Business for Sale

A profitable e-commerce brand in the car fashion niche, offering custom aesthetic products with steady revenue, strong branding, and growth potential.

Asking Price:

Sold

Feb 19, 2025

Health and Beauty

Relaxation Pads E-commerce Business for Sale

A 2+ Year Old Brand Selling Relaxation Pads. Total Revenue $2.75M | Total Net Profit $680k+ | Ready To Be Scaled Into New SKUs & Possible Subscription Based

Asking Price:

$190,000

Feb 19, 2025

Health and Beauty

Hair Growth Products Ecommerce Business for Sale

A 1-year-operated wellness DTC brand with high AOV and margins.

Asking Price:

$49,000

Feb 18, 2025

Laset Cutting & 3D Printing E-commerce Business for Sale

Business that dominates the Laser Cutting and 3D Printing market in the US. Digital products, evergreen niche, automated business with growth opportunities.

Asking Price:

$70,000

Feb 18, 2025

Home

Home Decor Lighting Shopify E-commerce Store for Sale

A growing US Based home dcor lighting brand generating $2.29M in revenue with $325k net profit.

Asking Price:

$550,000

Feb 17, 2025

Health and Beauty

High-Potency Vitamin E-commerce Website for Sale

An 8 Month Old Branded High-Potency Vitamin Store Scaling In The U.S Market. Revenue Generated $1.4M | Net Profit $293k | Ready To Turn Subscription Based

Asking Price:

$255,000

Feb 17, 2025

Health and Beauty

Hair Loss Solution Shopify Business for Sale

A 4-Months-Old ecom brand selling a hair-loss solution on the US Market. $343K Rev & $76K profits

Asking Price:

$120,000

Feb 17, 2025

Sports and Outdoor

Mini Punch Bag E-commerce Business for Sale

A fast-growing, viral ecommerce brand selling a unique mini punching bag, $820k TTM Rev / $150k TTM Profits. Strong community and following around the brand.

Asking Price:

$242,813

Feb 14, 2025

Fashion

Clothing Brand E-commerce Business for Sale

Clothing brand 2.5m in lifetime sales. You likely will of seen one of our trademarked designs. Everything in the brand has been automated. Turnkey opportunity

Asking Price:

$92,500

Feb 14, 2025

Apple Watch Accessories E-commerce Store for Sale

1.2y old US-based Apple Watch Accessories brand|$3M USD yearly revenue| 13% profit margin|12% Returning Customers

Asking Price:

Sold

Feb 14, 2025

Profitable Headphones E-commerce Business for Sale

9-month-old US-based online e-commerce business for sale in the headphones niche, earning $12,476/month. Ideal for expanding your Shopify store or internet business!

Asking Price:

Sold

Feb 14, 2025

Home

Destination-Themed Candles E-commerce Website for Sale

A 1+ Year Old Branded Candle Store With Local U.S Fulfilment. With $348k In Revenue & $125k in NET Profit. Ready To Be Scaled Into New SKUs

Asking Price:

$145,000

Feb 14, 2025

Home

Custom Pets Artwork PoD E-commerce Store for Sale

Shopify | Digital / Physical Product | Pet niche | Print-on-demand | We have been an industry leader in our niche for the last 4 years with excellent reviews.

Asking Price:

$143,874

Feb 13, 2025

Innovative Drink Dispensers Shopify Store for Sale

A 1 Year Old Shopify Brand Selling Innovative Drink Dispensers. $300k+ Revenue With $140K+ Net Profit, 50% Margins. Organic Brand, Automated And Easy To Scale.

Asking Price:

$130,000

Feb 12, 2025

Health and Beauty

Hair Extensions E-commerce Brand for Sale

A 2-Year-Old Hair Extensions Brand Running Worldwide. A Total Revenue Of $9M With $2M In NET Profit. Customer List of 120k With A Social Following Of 165k

Asking Price:

$225,000

Feb 12, 2025

Memorial Niche Shopify Store for Sale

A 1 Year, 1 Month Old Shopify Brand In The Memorial Niche. Custom Product & Software. $170K+ Profit, $400K+ Revenue, 50% Margins. Automated, 300+ Affiliates.

Asking Price:

$149,000

Feb 12, 2025

Personal Care

Hair Clipper E-commerce Store for Sale

Profitable Subscription Business on Autopilot - $400k+ in Upcoming Subscription Profits - Instant Fading Clippers - Exclusive Products - Minimal Work Required

Asking Price:

$390,000

Feb 7, 2025

Health and Beauty

Recovery & Wellness Niche E-commerce Business for Sale

A premium profitable ecommerce brand in the recovery niche, generating consistent profits with strong margins. $534k TTM Rev / $119k profits

Asking Price:

$140,000

Feb 7, 2025

Health and Beauty

Health Supplements Ecommerce Business for Sale

Thriving Branded Health Supplements eCommerce business established in 2019 | TTM $1.0M+ Revenue |Strong profit margin of 50%

Asking Price:

Sold

Feb 7, 2025

Health and Beauty